Financial Implications: Decoding the Hidden Costs and Strategic Opportunities of Global Market Shifts

Financial Implications: Decoding the Hidden Costs and Strategic Opportunities of Global Market Shifts

In an era defined by rapid technological innovation, geopolitical volatility, and climate-driven disruptions, financial systems worldwide face unprecedented strain. The ripple effects of shifting policies, supply chain realignments, and evolving consumer behaviors are no longer abstract trends—they translate directly into tangible financial consequences for businesses, governments, and investors. Understanding these implications is no longer optional for risk mitigation but essential for long-term strategic positioning.

Obscured behind complex data and fluctuating markets lie fundamental financial realities that demand clear, actionable insight.

Inflation, Interest Rates, and the Cost of Capital

Central banks’ responses to inflationary pressures have triggered one of the most significant financial recalibrations in decades. After years of ultra-low rates, rates have risen sharply to contain soaring price growth—with the Federal Reserve, European Central Bank, and other major monetary authorities tightening policy across multiple jurisdictions.These decisions reverberate through every layer of the economy. Higher borrowing costs directly increase the financial burden on corporations seeking capital and elevate homeownership and consumer debt servicing for individuals. “Every percentage point increase in long-term interest rates compounds over time, dramatically raising the total cost of multi-decade obligations,” notes Dr.

Elena Torres, a senior economist at the Global Financial Institute. “For companies with floating-rate debt, near-term payment shocks can threaten liquidity and solvency if cash flows aren’t carefully managed.” Beyond interest rates, persistent inflation pressures squeeze profit margins. Businesses face dual pressures: rising input costs while lacking pricing power to fully pass expenses to consumers.

Retailers, manufacturers, and service providers alike must restructure cost models or absorb losses—reshaping investment priorities and capital allocation strategies. In high-inflation environments, traditional financial forecasting tools often falter, requiring dynamic modeling and scenario planning to maintain accuracy.

Supply Chain Disruption and Financial Resilience

Global supply chain vulnerabilities exposed by the pandemic and compounded by geopolitical tensions have forced a reevaluation of operational risk and financial stability.Companies that relied on lean, just-in-time models now confront not only delays but escalating insurance premiums, inventory holding costs, and lost revenue. According to a 2023 McKinsey report, supply chain disruptions added an average of 15% to global logistics expenses, with niche industries experiencing increases exceeding 25%. “The financial impact extends beyond immediate costs,” explains supply chain risk analyst Rajiv Mehta.

“It erodes working capital, increases borrowing needs, and undermines revenue forecasts—especially when delays cascade through tiers of suppliers.” For multinational firms, currency volatility and port congestion amplify unpredictability, complicating financial planning and cash flow forecasting. Forward-thinking organizations are investing in diversified sourcing, nearshoring, and digital supply chain platforms to reduce exposure. These measures, though costly upfront, deliver long-term financial resilience by decreasing dependency on single regions and minimizing exposure to sudden shocks.

Climate Risk and the Revaluation of Assets

Climate change is reshaping financial risk assessment with growing urgency. Physical risks—from hurricanes and wildfires to prolonged droughts—damage infrastructure and disrupt business continuity, while transition risks—driven by policy shifts and carbon pricing—devalue fossil fuel assets and reshape industry fundamentals. Investors increasingly demand transparent climate risk disclosures, with the Task Force on Climate-related Financial Disclosures (TCFD) setting new benchmarks for reporting.“Climate risk is no longer a peripheral concern but a core financial determinant,” asserts Dr. Lena Wu, a senior climate economist at the Institute for Sustainable Finance. “Fixed assets tied to high emissions face devaluation, and companies slow to adapt risk losing market access, insurance coverage, and capital.” Real estate markets reflect this shift: coastal properties face declining valuations as flood risks escalate, while energy transition investments—renewables, green hydrogen— attract record financing.

Financial institutions are recalibrating credit models, factoring in climate scenario analyses to preserve portfolio integrity. For corporations, integrating environmental, social, and governance (ESG) into financial strategy is now critical—not only for compliance but for maintaining investor confidence and access to capital.

Digital Transformation and the Evolution of Financial Operations

The acceleration of digital technologies is redefining financial efficiency and transparency.Automation, artificial intelligence, blockchain, and real-time analytics are streamlining accounting, audits, fraud detection, and payment systems, reducing manual errors and operating costs. Firms leveraging digital tools report measurable gains: up to 40% improvement in invoice processing speed, 30% lower error rates, and enhanced compliance monitoring. “Digital transformation enables predictive financial management—enabling early detection of liquidity shortfalls and fraud,” states David Chen, CFO of a leading fintech firm.

“It shifts finance from reactive reporting to strategic foresight.” Yet the transition demands significant investment. Cybersecurity, upskilling talent, and integration complexity present financial hurdles. Despite these, organizations that embrace

Related Post

Jayla Foxx and Popeyes: A Cultural Fusion Rooted in Style, Fame, and Fast Food Charm

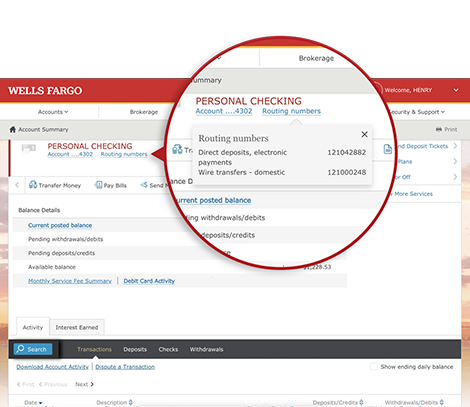

Decode the Wells Fargo Routing Number: The Key to Smarter Banking Transactions

Unveiling The Height Of Julia Duffy: Discoveries And Insights

The Life And Legacy Of Lowell Lee Andrews: A Notorious Figure Shaped by Violence, Madness, and Media