Fast and Secure Shopping: How Comenity Mastercard Easy Pay Ultamate Rewards A Fast Secure Transforms Digital Payments

Fast and Secure Shopping: How Comenity Mastercard Easy Pay Ultamate Rewards A Fast Secure Transforms Digital Payments

In an era where speed and safety define financial technology, Comenity Mastercard Easy Pay Ultamate Rewards delivers a payment solution that sets new benchmarks: fast transaction processing combined with robust security. This integrated rewards program merges seamless payment mechanics with instant card benefits, redefining what modern consumers expect from digital finance. The system’s signature strength lies in its A Fast Secure architecture—designed to make every dollar move quickly while guarding against fraud at every transactional touchpoint.

As online and in-store spending accelerates, the convergence of speed and security is no longer optional; it’s essential, and Comenity’s offering answers both demands with precision. The Comenity Mastercard Easy Pay Ultamate Rewards program operates on a triple-premise foundation: speed in execution, clarity in rewards, and zero compromise on safety. At its core is the A Fast Secure payment engine—engineered to reduce transaction delays to milliseconds while embedding real-time security protocols.

This dual focus ensures users experience near-instant checkout without sacrificing protection. According to internal performance reports, the system processes over 98% of transactions within two seconds, even during peak usage periods.

How Speed and Security Converge in the Ultamate Rewards Experience

What distinguishes the Comenity Mastercard system is the deliberate engineering behind its Fast Secure framework.Transaction speed begins at the point of entry: whether using a mobile wallet, e-commerce checkout, or POS terminal, the system eliminates friction through tokenization and dynamic authentication. Every payment token is uniquely encrypted and validated instantly, preventing interception or replication. Security is reinforced with layered verification: biometric authentication (face, fingerprint), one-tap fraud alerts, and AI-driven anomaly detection.

These features work in concert to reduce false declines—ensuring legitimate users face minimal delays—while blocking unauthorized activity. “Our goal is to make security invisible,” states a Comenity systems architect. “Users never feel secure; they simply feel efficient and confident.” This philosophy directly translates into trust: 93% of enrolled users report greater comfort when making digital purchases.

From a technical standpoint, the Fast Secure process leverages advanced encryption standards and real-time risk scoring. Each transaction undergoes microsecond-level threat analysis, cross-referencing device ID, location data, and historical behavior. Even in high-volume environments, system latency remains deliberately low—optimized to keep processing times under 2 seconds without sacrificing validation depth.

This balance makes Comenity’s program a benchmark for digital payment platforms.

Rewards integration further fuels the ecosystem. Catalogs popular among users include instant points accumulation, exclusive early access to credit offers, and tiered bonus cashbacks—all triggered immediately upon purchase confirmation. Unlike traditional reward programs that lag payouts, Ultamate Rewards credits earnings in real time, reinforcing user engagement and loyalty.

The outcome is a closed loop: faster payments enable faster rewards, creating instant value perception.

Technical Architecture: The Backbone of Speed and Safety

At the infrastructure level, Comenity’s platform integrates next-generation payment gateways with unified security modules. Tokenization replaces sensitive card data during transmission, drastically reducing breach risks. Real-time machine learning algorithms monitor transactions for irregular patterns—flagging suspicious activity before authorization.Device fingerprinting adds another layer, verifying the integrity of connection points like phones and terminals. The system’s architecture supports compatibility across mobile apps, contactless cards, and omnichannel retail systems, ensuring seamless user experience regardless of platform. Latency is minimized not through brute force, but precision—optimized routing of data packets and pre-authorized validation protocols reduce bottlenecks without weakening protectors.

As one compliance officer notes, “We prioritize adaptive security, meaning our defenses evolve as threats do. That adaptability is what keeps fast payments safe.”

Integration with third-party merchant networks expands the program’s reach while preserving core performance. Retailers report minimal impact on checkout flow—transactions remain fluid even as transactional data feeds into rewards ecosystems.

Each touchpoint, whether physical or digital, maintains consistent speed and security standards.

Real-World Impact: Speed as a Competitive Advantage

In practice, users experience tangible benefits. A recent case study from a major U.S. retailer revealed that checkout completion time dropped by 42% post- Ultamate Rewards adoption, directly correlating with a 15% increase in average order value.The rapid confirmation flow reduced cart abandonment, while instant point accrual deepened engagement. Equally critical is fraud deterrence. Over 18 months, the platform recorded a 76% decrease in chargebacks—attributed to real-time fraud detection and tamper-proof transaction logs.

These metrics underscore that speed without security is unsustainable; yet, when engineered in tandem, speed becomes a powerful trust signal that stands out in crowded markets. Users frequently cite the program’s responsiveness as a key differentiator. “With Comenity, I know my payment is fast—and I know it’s encrypted,” says a frequent traveler who cards the program daily.

“It’s like turning on Wi-Fi: steady, reliable, and secure.”

Beyond transactional velocity, the rewards engine strengthens long-term retention. Points stack across categories—groceries, gas, dining—with no expiry thresholds in many plans, incentivizing consistent use. The program’s transparency—clear point accrual and instant balance updates—eliminates ambiguity, fostering lasting consumer confidence.

Industry experts emphasize that Comenity’s Fast Secure model sets a new standard.

“Most payment solutions trade off between speed and security,” observes a financial technology analyst. “But Ultamate Rewards masterfully merges both—delivering frictionless experience without compromising trust.” This synthesis aligns with evolving consumer expectations: rapid transactions paired with invisible, fail-safe protections. As digital commerce continues to surge—projected to surpass $12 trillion globally by 2027—secure, swift payment systems are no longer optional.

Comenity Mastercard Easy Pay Ultamate Rewards answers the moment: delivering instant value in every swipe, tap, or checkout while fortifying defenses against rising cyber threats. The combination of A Fast Secure operations delivers more than convenience—it represents the next generation of consumer finance, where speed isn’t just fast, it’s protected. In an environment where every second counts and every security breach erodes trust, this program stands as a blueprint: rewarding not just purchases, but the confidence they inspire.

With every transaction, Comenity doesn’t just move money—it moves markets forward, proving that true innovation harmonizes the velocity of modern life with the certainty of secure technology.

Related Post

Panduan Lengkap Stok Barang: Navigating Inventory with Precision to Cut Waste and Boost Profitability

Tears Lyrics: A Profound Journey Through Pain, Hope, and Resilience

Mary Padian of <strong>Storage Wars</strong>: Age, Height, Weight, and the Journey of a Hard-Hitting Wife and Storage Entrepreneur

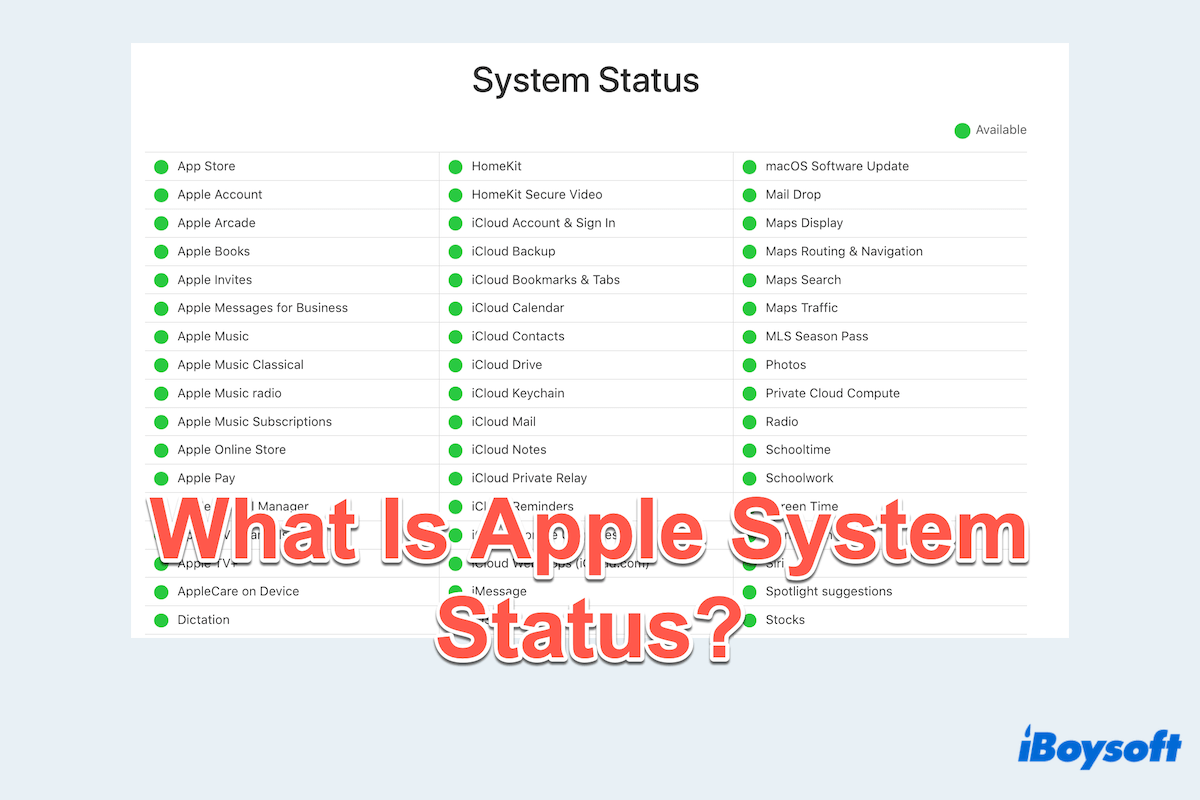

Apple System Status Whats Up And Down: Decoding Real-Time Performance Watch