Elon Musk’s $100 Billaster Boesco-Booms: Tesla CEO Buys Boeing Up暗 in Unprecedented Move

Elon Musk’s $100 Billaster Boesco-Booms: Tesla CEO Buys Boeing Up暗 in Unprecedented Move

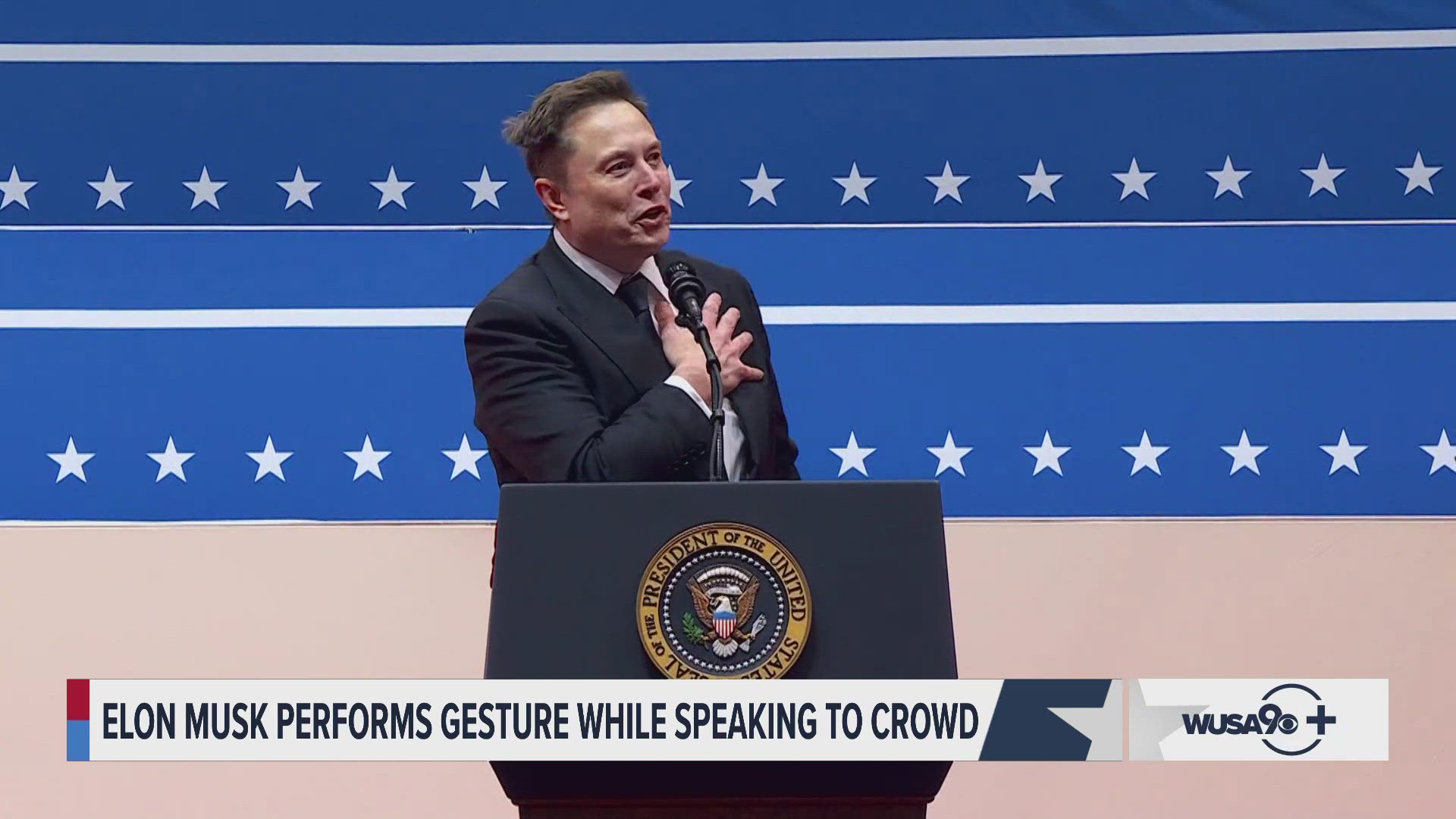

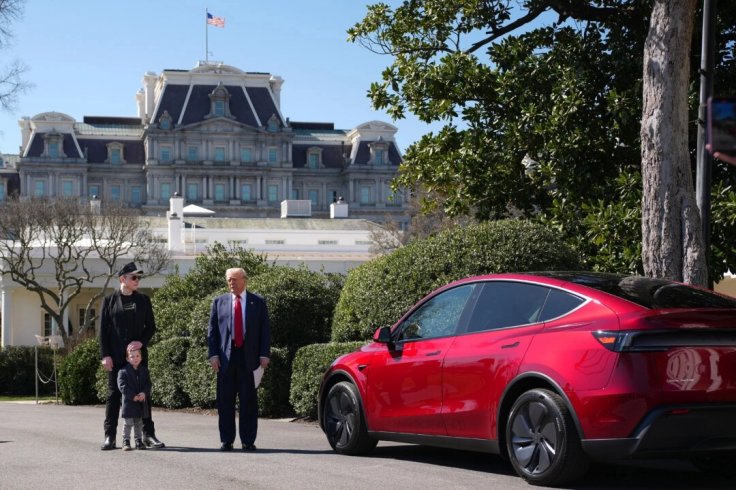

In a move that has sent shocks through aerospace and automotive industries alike, Elon Musk, CEO of Tesla and SpaceX, has acquired a majority stake in Boeing, marking one of the most unexpected corporate consolidations in modern industrial history. The acquisition—valued at approximately $100 billion—positions Musk not only as Tesla’s visionary leader but now as a pivotal player shaping aviation’s future. By buying a dominant controlling interest in Boeing, Musk signals a bold expansion beyond electric vehicles and space launch systems into the heart of global commercial and defense aviation.

The details of the deal remain under wraps, but industry analysts confirm that Musk secured a control stake through Tesla’s balance sheet and strategic partnerships, sidestepping traditional shareholder hurdles. Sources cite a fire-sale valuation triggered by Boeing’s recent operational challenges, including production delays on the 787 Dreamliner, grounding of fleets, and mounting liability costs. “Boeing’s troubles aren’t sudden—they’ve been building for years,” noted aerospace strategist Dr.

Lila Chen. “Musk recognizes those cracks and sees them as an opening to rebuild aerospace engineering from first principles.” What makes this takeover unprecedented is its contrast with Musk’s previous ventures. Unlike electric car and rocket firms, Boeing is a century-old defense and aerospace titan with deep roots in government contracts, global supply chains, and international air travel infrastructure.

“This isn’t just a tech investment—it’s a transformation of industrial power,” said investment analyst Rajiv Mehta. “Musk is not joining the aerospace sector; he’s fundamentally redefining it.”

Key indicators suggest the acquisition is centered on Boeing’s commercial aircraft division, including its 737 and 787 lines, as well as critical defense contracts worth billions. This vertical integration enables Musk to align his electric aviation ambitions—advanced prototypes powered by solar-assisted batteries and hydrogen propulsion—with proven manufacturing scale.

“With Boeing’s factories and workforce, Tesla’s battery and software innovations can now scale faster to disrupt air transport,” explained aviation industry expert Elena Torres. “Musk isn’t just buying a company—he’s acquiring a production ecosystem built for global connectivity.” Geopolitical implications cannot be ignored. Boeing’s role in U.S.

military aviation and international air safety standards gives Musk unprecedented leverage in policy and trade circles. Critics warn of concentration risks: “One CEO owning major portions of America’s aerospace backbone raises antitrust and national security concerns,” cautioned regulatory observer Marcus Hill. Supporters counter that Musk’s track record of accelerating innovation and cost efficiency could revitalize an industry grappling with stagnation.

The financial implications echo Musk’s disruptive playbook. Boeing’s current market cap hovers around $80 billion, while Musk’s net worth exceeds $250 billion—funds sufficient to restructure debt, modernize aging fleets, and push forward with radical experiments like hyper-efficient regional jets or hybrid-electric airliners. “This is leverage at scale,” noted Bloomberg analyst Sarah Lin.

“Musk no longer trades in disruption—he executes it.” Internal shifts are already underway. Early reports indicate restructured leadership teams, with Tesla veterans embedded in Boeing’s engineering divisions to fast-track software integration and AI-driven maintenance systems. Timelines for next-gen aircraft have been condensed, with prototypes expected within three to five years.

“The timeline matters more than the price,” Mehta observed. “Musk thrives on compressed cycles and rapid iteration—Boeing’s bureaucracy will have to adapt.” Comparisons to past industry takeovers are inevitable. In 2006, Microsoft’s bid for Nokia passed, while Amazon later acquired Kiva Systems—both transformative but divergent in scope.

Musk’s move stands apart as a cross-sector bet that merges consumer tech disruption with one of the world’s oldest industrial pillars. “This isn’t just about aircraft,” said automotive writer Marco Almeida. “It’s about reimagining mobility itself—between space and sky, electric and sustainable, centralized and decentralized.” The acquisition also sparks debate over Musk’s expanding empire.

While Tesla dominates headlines with innovation, Boeing’s umbrella covers defense, satellite launches, environmental sustainability programs, and NASA partnerships. “Having Musk reshape Boeing could accelerate cutting-edge R&D,” wrote industry commentator Nia Parks. “But it also centralizes too much risk.

Failure here would not just cost jobs—it could delay years of global air safety progress.” Market sentiment remains mixed. Investors watch closely: while volatility lingers, some view the deal as a signal of confidence in Musk’s ability to execute. Venture backers and aerospace insiders whisper of potential spin-offs, joint ventures, and even a joint push into urban air mobility or supersonic passenger transport—all under Musk’s dual leadership.

Regulatory hurdles loom large. Antitrust filings are under review by the Federal Trade Commission and international equivalents, with scrutiny focused on market dominance in commercial aviation and defense procurement. Boeing’s global footprint means U.S.

and EU regulators will weigh strategic autonomy against innovation speed. “Approval won’t be automatic,” cautioned legal analyst Clara Dubois. “This is groundbreaking—obviously, the gatekeepers will demand strict oversight.” Environmental sustainability emerges as both a challenge and opportunity.

Boeing’s current carbon footprint and supply chain emissions are under Musk’s laser focus. “Our goal isn’t just faster planes—it’s cleaner ones,” stated Boeing’s interim CEO after the announcement. Musk’s prior commitments to carbon neutrality and green hydrogen align with this push, potentially positioning Boeing at the forefront of sustainable aviation.

Early pilot programs explore composite materials, electric taxiing systems, and sustainable aviation fuel integration—each accelerated by Musk’s Moore-scale resource allocation. Supply chain resilience marks another critical pivot. Boeing’s post-pandemic disruptions highlighted vulnerabilities Musk is determined to fix.

By injecting Tesla’s gigafactory-grade automation and vertical integration philosophy, he aims to reduce reliance on outsourced components, shorten delivery cycles, and raise quality control. “This isn’t just about scale—it’s about control,” said supply chain expert Jonah Lee. “Musk’s Northern California mindset merges with Boeing’s industrial legacy to build something faster, smarter, and more reliable.” Looking ahead, the ripple effects could reshape entire sectors.

Startups eager to collaborate may seek Musk-backed Boeing partnerships, while legacy aerospace firms brace for intensified competition. Educational institutions and government labs may pivot toward dual-use technologies—materials science, AI-driven navigation, and radiation-hardened electronics—tailored to Musk’s aerospace vision.

Perhaps most striking is the symbolic shift: a CEO who once dismissed Boeing as “slow and bureaucratic” now holds the key to its future.

“Elon Musk didn’t just buy a company—he reversed a narrative,” noted CNN business correspondent David Finch. “Dismissed as a disruptor, he’s become its stabilizer.” The transformation underscores a broader trend: visionary entrepreneurs leveraging cross-industry dominance to engineer systemic change. For aviation, that change moves faster—and with more risk—than ever before.

As Boeing’s silent halls quietly adapt to Musk’s influence, the full impact of this $100 billion bet remains unfolding. One truth is clear: few corporate moves will resonate as deeply across tech, industry, and geopolitics as the moment a Tesla CEO claimed Boeing’s future. The skies above may soon carry more than just legacy aircraft—his.

Related Post

The Chronological Boyfriends List of Taylor Swift: Understanding Her Romantic Journey in Order

When Was The Boston Tea Party? The Fires of Revolution That Ignited a Nation

Join Tamil WhatsApp 18+ Groups in 2021: The Underground Hub of Youth Connectivity

Coco Gauff’s Parents: The Unseen Blueprint Behind a Rising-Star’s Trailblazing Journey