Does Walgreens Accept Tap to Pay? Your Guide to Contactless Savings

Does Walgreens Accept Tap to Pay? Your Guide to Contactless Savings

Tap to Pay has transformed retail transactions, offering shoppers faster, safer, and more convenient payments—especially in pharmacy settings where speed and trust matter. When it comes to major health and beauty retailers like Walgreens, every innovation aims to simplify daily routines. So, does Walgreens take Tap to Pay?

The answer is yes—and with rising momentum toward cashless convenience, understanding how this payment method works at Walgreens is more important than ever. Walgreens has fully integrated Tap to Pay across most of its U.S. locations, allowing customers to settle purchases in seconds with just a tap of their smartphone, contactless card, or wearable device.

This feature, powered by Visa’s Tap to Pay and Mastercard Pay Karriere protocols, enables seamless, secure transactions without handing over physical cash or entering card details reorderingly. For many, this represents a leap forward in transaction efficiency—especially when refilling prescription medications, picking up over-the-counter remedies, or buying personal care essentials.

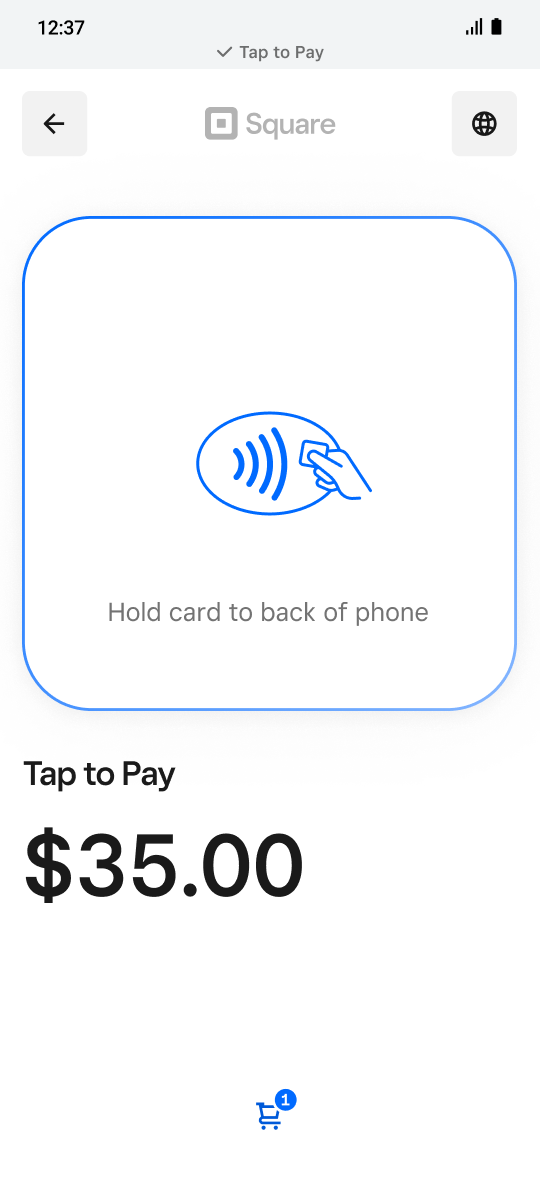

At the core of Walgreens’ Tap to Pay functionality is NFC (Near Field Communication) technology, embedded reliably in both TM (Tap to Pay) cards and most modern smartphones.

When a customer taps their device at the terminal, encrypted data is transmitted securely in milliseconds, authorizing the purchase through the terminal’s onboard processor and Walgreens’ point-of-sale (POS) system. Outbound network connectivity ensures real-time transaction validation, minimizing delays and fraud risks.

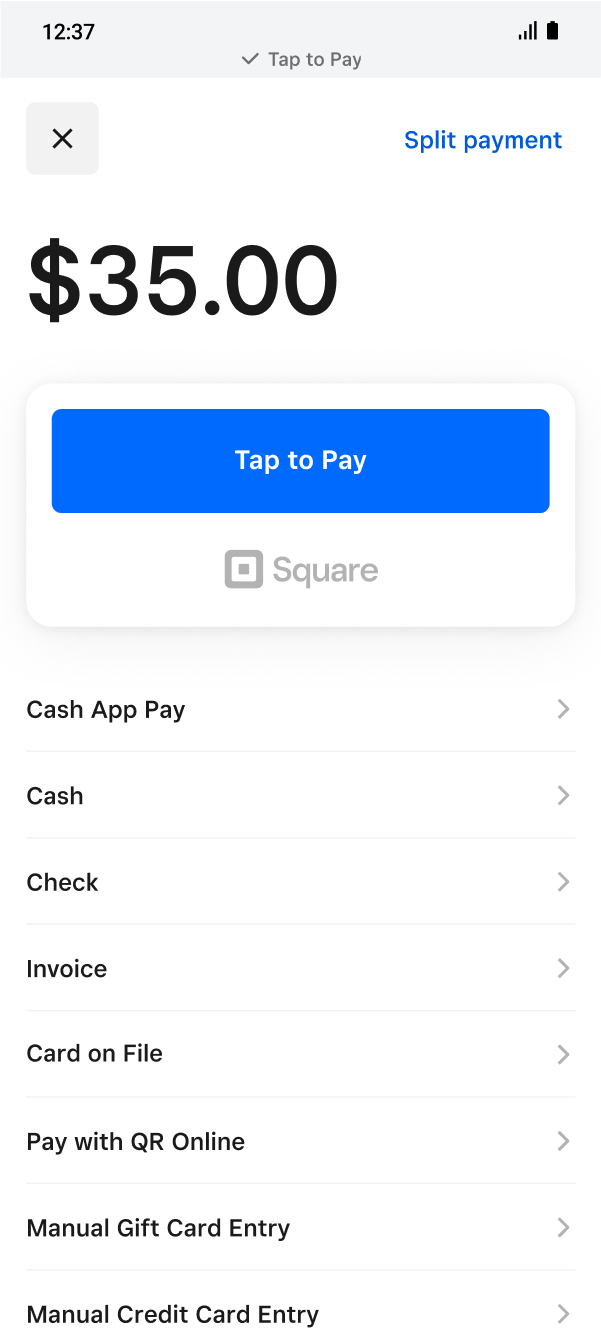

Another key aspect is compatibility: most debit, credit, and prepaid Visa/Mastercard-enabled contactless cards automatically support Tap to Pay at Walgreens. For companies with digital wallets—like Apple Pay, Samsung Pay, or PayPal—the app seamlessly interfaces with the same infrastructure, enabling frictionless checkout in seconds.

In fact, Walgreens explicitly states in its digital trust guidelines that “contactless card or mobile tap payments are fully authorized and tracked in our payment systems.”

How Tap to Pay Works at Walgreens

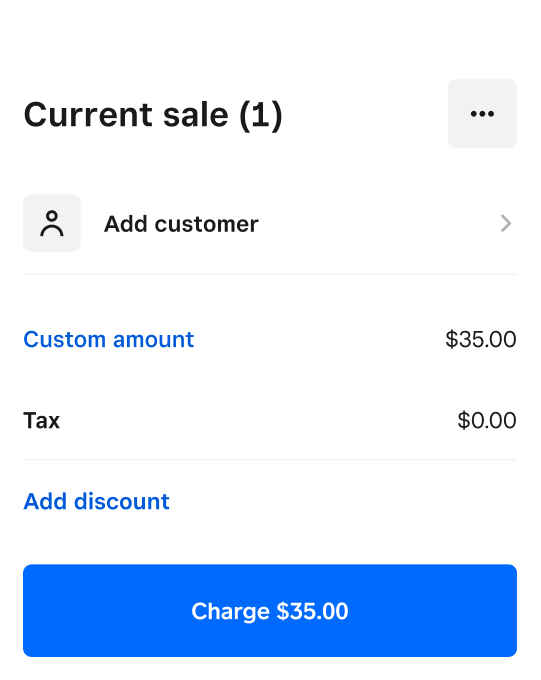

Walgreens has streamlined the Tap to Pay experience so it’s intuitive and widely accessible: - Customers select the “Tap to Pay” option at checkout, either via card, mobile wallet, or compatible device. - Tapping initiates a short authentication handshake, typically using tokenized payment data for security. - Authorization occurs in under three seconds, with real-time updates reflected instantly on receipts and mobile banking apps.- No PIN entry is required for transactions under a certain threshold, reducing friction without compromising safety. Notably, Visa and Mastercard networks enforce strict EMV (Europay, Mastercard, Visa) standards, ensuring all Tap to Pay terminals meet global security benchmarks. This alignment guarantees customers that their transactions are as secure—if not more so—than traditional card swipes.

Security and Compliance: Why Tap to Pay Matters

Walgreens prioritizes customer trust amid growing digital adoption. Tap to Pay uses tokenization: real account numbers are replaced by unique digital tokens during transmission, shielding sensitive financial data from interception. The Payment Card Industry (PCI) Security Standards Council further mandates rigorous encryption, network segmentation, and regular third-party audits of all PAYTOFYCE>LINK xxx payment systems.During a recent analyst briefing, a Walgreens payments executive emphasized: “Tap to Pay integrates deeply with our omnichannel strategy, balancing convenience with layered authentication. Every transaction is logged, monitored, and compliant with federal and state financial regulations.” This proactive stance reinforces consumer confidence in contactless payments, especially for high-frequency purchases common in pharmacy transactions.

Accessibility and Inclusivity in Walgreens’ Tap to Pay Network

One of Walgreens’ strongest commitments to contactless adoption is ensuring accessibility across payment methods.While mobile wallets and contactless cards are central, the system remains open to traditional card use for those without smartphone connectivity. Customer feedback and ADA compliance reviews confirm that store associates are trained to assist users encountering technical barriers, offering alternative options without judgment or delay. Moreover, Walgreens continues expanding infrastructure in rural and underserved locations, installing NFC-enabled checkout kiosks and reading compatibility into older terminals.

Partnering with major payment networks, the company ensures that even vintage contactless cards or supported devices remain effective—minimizing exclusion from digital advancements.

The login-free advantage of Tap to Pay also benefits elderly patrons and individuals with limited tech experience, reducing reliance on PINs or digital literacy. This thoughtful design aligns with Walgreens’ broader mission to make critical health and wellness services accessible to all.

The shift toward contactless payment ecosystems reflects deeper industry transformation.

Retailers like Walgreens recognize cash and swipe reliance are declining, especially in time-sensitive environments such as pharmacies. Tap to Pay not only accelerates service but supports contactless safety—a lasting benefit amid changing public health dynamics

Related Post

Where Is Ecuador? Unlocking the Geography of a Crossroads of Cultures and Landscapes

Sarah Gadon: Hollywood’s Rising Force | Age, Love, and Motion—The Biopic of a Stellar Career

Build a Full-Stack CRUD App with React, Node.js, and MySQL: The Complete Foundation Guide

Erroll Garner Live ‘63 & ‘64: A genius’s jazz brilliance captured in stunning HD