Definition of Trustee Model: The Cornerstone of Fiduciary Responsibility in Modern Trust Management

Definition of Trustee Model: The Cornerstone of Fiduciary Responsibility in Modern Trust Management

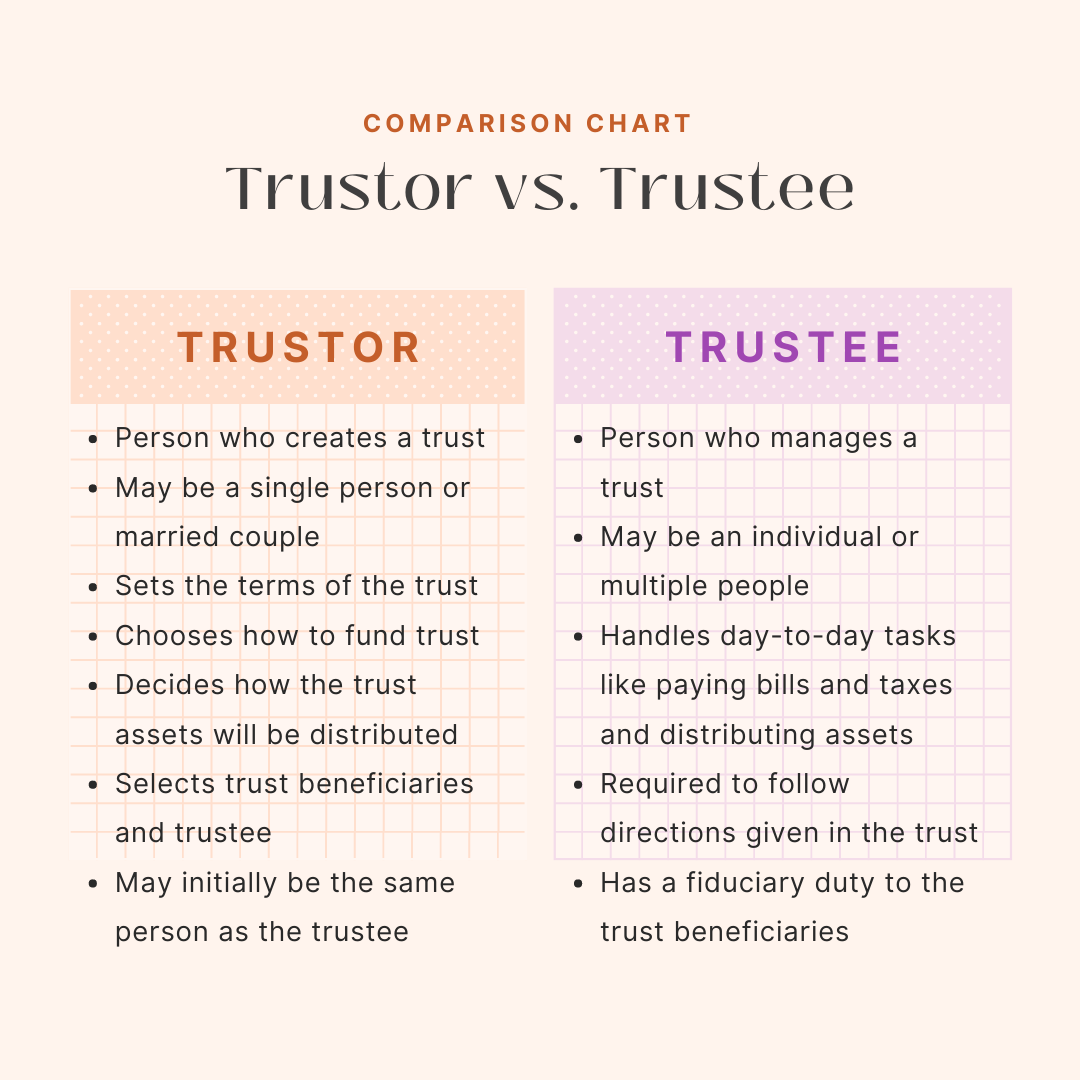

In the intricate landscape of trust law, the trustee model stands as a foundational framework defining how trustees manage assets, fulfill fiduciary duties, and serve the interests of beneficiaries. Defined as the legal and operational blueprint through which trustees administer trusts, this model establishes the scope of authority, responsibilities, and accountability essential to maintaining trust integrity. At its core, the trustee model ensures that fiduciaries act not merely as caretakers, but as vigilant stewards bound by strict legal standards and ethical obligations.

The trustee model is more than a procedural mechanism—it is a dynamic governance structure designed to balance control with transparency. *“A trustee’s role transcends holding title; it is about acting in the best interests of each beneficiary with honesty, diligence, and unwavering loyalty,”* explains Dr. Elena Marquez, a leading authority in trust and estate law.

This principle underpins the model’s enduring relevance across diverse trust arrangements, from simple trusts holding personal assets to complex institutional portfolios managed by multi-jurisdictional trustees.

Core Components of the Trustee Model

The trustee model centers on several key functional and legal pillars that shape fiduciary conduct:- Fiduciary Duty: Trustees are legally bound by three core obligations: loyalty, care, and impartiality. As the American Bar Association spells it, “Fiduciaries must prioritize beneficiary interests above all else, avoiding conflicts and acting with the prudence of a seasoned professional.”

- Scope of Authority: Defined either expressly in the trust instrument or as inherent by law, the trustee’s powers encompass asset management, distribution decisions, tax compliance, and the ability to seek professional advice when necessary.

- Accountability Mechanisms: The model mandates regular reporting, audit trails, and, where required, court oversight to ensure transparency and prevent misuse of trust resources.

- Beneficiary Relations: Trustees must communicate clearly and fairly, ensuring beneficiaries understand their rights and the basis for all decisions—especially distributions and investment actions.

The trustee model’s legal architecture draws from common law principles and statutory frameworks, varying slightly by jurisdiction but united by core tenets. In the United States, for instance, the Uniform Trust Code (UTC) standardizes model provisions, promoting consistency across states while preserving flexibility for trust creators. Internationally, comparable models exist in jurisdictions governed by the UK Trustee Act or the Canadian Trusts Act, illustrating a global consensus on fiduciary excellence.

Operational Applications Across Diverse Trust Structures

The versatility of the trustee model is evident in its adoption across a spectrum of trust types, each adapting the core model to meet unique needs.In revocable living trusts, often used to manage assets during a grantor’s lifetime, the trustee—frequently the grantor themselves—exercises broad operational latitude while remaining accountable post-death. Here, the model enables smooth asset transitions, estate tax optimization, and avoidance of probate, all while maintaining strict fiduciary conduct. As legal analyst Thomas Reed notes, “In revocable trusts, the trustee model acts as both a tool and a trust—balancing flexibility with enduring responsibility.” In contrast, irrevocable trusts, which relinquish control by the grantor, require trustees to exercise watchful independence.

These arrangements—common in retirement planning or charitable contexts—demand trustees to act as impartial arbiters, protecting beneficiaries from mismanagement. For example, in a charitable remainder trust, the model ensures that income distributions align with donor intent and regulatory requirements, preserving both purpose and compliance.

Specialized trusts, such as spending trusts for minors or special needs trusts, extend the trustee model’s utility further by embedding tailored governance rules.

These adaptations reflect its responsiveness to evolving social and legal demands, ensuring trusts remain effective in protecting vulnerable populations.

Risk Management and the Trustee Model’s Protective Role

At the heart of the trustee model lies a robust risk mitigation framework. Trustees are shielded legally when they act reasonably, informed, and in accordance with documented policies—protections reinforced by statutes like the UTC, which codifies the “prudent investor rule” and limits personal liability for honest errors.This legal insulation encourages active stewardship without excessive hesitation, empowering trustees to navigate market volatility and complex compliance landscapes confidently.

Risk is managed through multiple channels: detailed trust accounting, routine performance reviews, and board-level oversight in institutional trustee appointments. Professional trustees, often firms with fiduciary insurance and compliance teams, bring expertise in investment strategy, tax planning, and litigation defense—critical guardrails in an era of heightened financial scrutiny and regulatory complexity.

In essence, the trustee model transforms fiduciary risk from liability into a structured, manageable responsibility anchored in due diligence.

Transparency and Beneficiary Trust: The Model’s Moral Engine

While legal compliance forms the trunk of the trustee model, beneficiary trust fuels its vitality. The model mandates not only accurate record-keeping but also proactive communication.Trustees must explain decisions, particularly major ones like estate liquidations or changes in investment policy, ensuring transparency becomes a daily practice, not a last-minute requirement.

This emphasis on clarity prevents assumptions and disputes, fostering long-term relationships grounded in mutual understanding. In practice, this means annual accountings that clarify income and principal developments, initial onboarding meetings outlining fiduciary responsibilities, and standing advisory panels where beneficiaries voice concerns.

“When beneficiaries feel heard and informed, trusts endure far longer than those governed by silence,” asserts Marquez. Such engagement elevates the model from a legal obligation to a relational cornerstone.

Emerging Challenges and the Future of the Trustee Model The trustee model faces evolving pressures, from digital disruption to shifting social expectations.

Cybersecurity threats demand enhanced data protection protocols, while the rise of robotic advisors and AI-driven portfolio tools forces trustees and trust companies to redefine their roles—balancing automation with human oversight.

Demographic changes also reshape demand: older populations require more sophisticated age-in-place trust arrangements, while younger beneficiaries expect digital access to trust portals and real-time updates. Firms adapting today integrate user-friendly technology while preserving core fiduciary principles, ensuring relevance without compromise.

Regulatory scrutiny remains intense, especially around ESG investing and climate-related disclosures, compelling trustees to align trust management with broader societal values—without straying from legal mandates. The model’s resilience lies in its adaptability: structured yet responsive, principled yet pragmatic.

Looking ahead, the trustee model is poised to deepen its role as a guardian of long-term stewardship in an unpredictable world.

Innovations in governance, enhanced beneficiary engagement, and global standardization will preserve its integrity while expanding its reach across

Related Post

Taco Bell Crispy Tenders: Exhaustive Macro & Calorie Breakdown You Need to Know

Unlock Your Cosmic Identity: What Your April 16 Zodiac Sign Really Reveals

15DividedBy2 Explained: Why 7.5 Matters in Daily Life and Global Systems

How Old Is Diddy? The Timeline Behind Sean “Diddy” Combs’s Rise to Foundation of Hip-Hop