Defining Capital Money: The Lifeline of Global Commerce

Defining Capital Money: The Lifeline of Global Commerce

Capital money is the financial backbone of modern economies—essentially, liquid assets and available resources used to fund operations, invest in growth, and sustain long-term economic activity. Far more than mere cash, capital money encompasses a range of financial instruments and liquid reserves, from equities and corporate bonds to venture capital and sovereign wealth funds. As economist John Maynard Keynes observed, “Capital is not just wealth in hand, but wealth that enables wealth creation”—a principle that underpins the strategic role of capital money in shaping industries, industries, and entire economies.

At its core, capital money fuels enterprise and innovation, serving as the fuel for business scalability and public infrastructure development. It enables firms to expand production, adopt new technologies, enter new markets, and weather economic downturns. For governments, capital money finances roads, schools, healthcare systems, and defense—foundations upon which national prosperity rests.

But capital money is not monolithic; its forms, uses, and management vary dramatically across private firms, financial institutions, and state ownership.

What Constitutes Capital Money? Defining the Components

Capital money includes both tangible and intangible assets deployed for productive purposes. The primary components include:- Cash and Cash Equivalents: This includes physical currency, balances in bank accounts, and short-term liquid instruments like treasury bills.

As a default medium of exchange, cash ensures immediate liquidity—critical for daily operations and emergency contingencies.

- Fixed Assets: Long-term tangible assets such as machinery, property, and equipment represent significant capital investments. These tangible resources form the physical foundation of manufacturing, logistics, and service industries, directly enabling production capacity.

- Financial Capital: This includes equity stakes in companies, bonds, and convertible debt—forms of capital used to raise funds through capital markets. Equity ownership provides long-term growth potential without repayment pressure, while bonds offer structured debt financing with fixed interest returns.

- Intellectual Capital: Often overlooked, intellectual capital—comprising patents, trademarks, brand value, and proprietary technology—plays a pivotal role in modern economies, particularly in tech and innovation-driven sectors.

As MIT economist Erik Brynjolfsson notes, “Intangible assets now account for over 70% of the market value of leading tech firms.”

Each component serves a unique function, forming a dynamic ecosystem where liquidity supports operations, fixed assets ensure production, and financial and intellectual capital generate lasting competitive advantage.

Capital Money vs. Working Capital: Understanding the Difference

A frequent source of confusion lies in distinguishing capital money from working capital, though the two serve distinct financial roles. Working capital—calculated as current assets minus current liabilities—measures a company’s short-term operational liquidity, reflecting its ability to meet immediate obligations like payroll and inventory costs.In contrast, capital money encompasses long-term funding sources used to invest in growth, technology, or infrastructural upgrades—assets that may take years to yield returns but are essential for enterprise sustainability.

For example, a manufacturer may boast strong working capital due to high inventory turnover, enabling smooth day-to-day operations. Yet, if its future competitiveness depends on automating production with robotics funded via long-term debt, that capital infusion falls into the capital money category—beyond the scope of working capital metrics.

The Strategic Use of Capital Money Across Sectors

Different industries deploy capital money according to their economic logic:- Technology and Innovation: Startups and established tech firms alike rely heavily on venture capital, private equity, and bond financing to fund research and development. Silicon Valley’s ecosystem thrives on this influx: companies like SpaceX and Tesla raised billions in private capital before scaling globally.

- Manufacturing and Infrastructure: Heavy industries use capital money to acquire production lines, build factories, and upgrade supply chains.

Nations investing in green energy infrastructure—think solar farms or electric grid modernization—allocate capital through public and private partnerships.

- Real Estate and Urban Development: Institutional investors deploy capital through REITs and large-scale development funds to build commercial spaces, housing, and commercial hubs, shaping metropolitan landscapes and economic districts.

- Government and Public Finance:

Related Post

Unraveling Layla Jenner Pussy: The Rising Obsession Behind a Controversial Media Phenomenon

Podiatrist’s Tragic Death: Beloved Footcare Specialist Murdered by Sons Who Then Take Their Own Lives

How Much Is 23KG in Pounds? The Simple Conversion That Pays Off in Every Sense

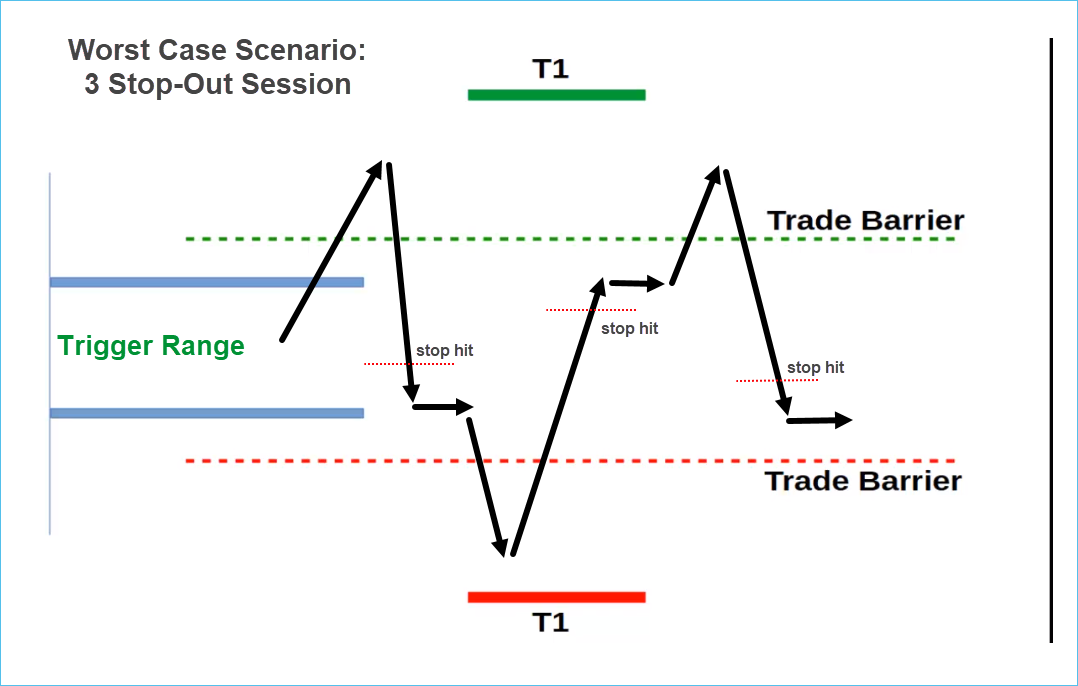

MACD Data Trading Strategies: Decoding Momentum with Precision in Volatile Markets