Decoding PSE, EHESS & ENS Finance Degrees: Where Elite Training Shapes Finance Careers

Decoding PSE, EHESS & ENS Finance Degrees: Where Elite Training Shapes Finance Careers

The landscape of financial education in France is defined by elite institutions—PSE, EHESS, and ENS Finance—each offering specialized programs that blend rigorous academic training with practical expertise. For aspiring finance professionals, these programs stand at the crossroads of theory and real-world application, delivering curricula deeply rooted in economics, quantitative analysis, and decision-making under uncertainty. By examining the core courses and career trajectories tied to these degrees, one discerns a clear pattern: these aren’t just academic qualifications—they are gateways to dynamic roles in banking, asset management, consulting, and fintech.

This article decodes the structure, content, and professional impact of finance degrees from PSE, EHESS, and ENS, revealing how each institution cultivates future finance leaders.

Program Architecture: Core Courses in Finance at PSE, EHESS & ENS

PSE—Paris School of Economics and Management—designed for future financial strategists, anchors its finance track in quantitative rigor and market analysis. Key courses include *“Macroeconomics of Financial Systems,”* where students dissect central bank policies and financial crises, and *“Financial Markets and Instruments,”* teaching derivatives, fixed income, and equity valuation.PSE emphasizes applied modeling, using real-world datasets to simulate trading strategies and risk scenarios. At EHESS—École Normale Supérieure’s specialized finance program—curriculum blends deep theoretical foundations with interdisciplinary research. Students engage in *“Econometric Methods in Finance,”* mastering statistical modeling for asset returns, alongside *“Behavioral Finance and Decision Theory,”* probing cognitive biases in market behavior.

EHESS courses are marked by their small class sizes and emphasis on critical thinking, producing graduates adept at synthesizing complex economic ideas with financial innovation. ENS Finance—operating under the intellectual banner of École Polytechnique—focuses on the frontiers of quantitative finance and financial engineering. Core offerings such as *“Stochastic Calculus for Finance”* and *“Machine Learning in Algorithmic Trading”* place students at the forefront of technological finance.

The program integrates advanced mathematics, computer science, and data analytics, preparing graduates to design AI-driven trading systems and manage large-scale financial data. Each institution structures its courses to progressively build analytical, technical, and strategic competencies, ensuring students emerge not only as financial analysts but as innovators capable of addressing evolving industry challenges.

Course Simplified: Key Pillars Across Programs

Analysis of the core curricula reveals three foundational pillars common to PSE, EHESS, and ENS finance degrees: - **Quantitative Proficiency**: Mastery of probability, statistics, and mathematical modeling forms the backbone of all programs.Courses like PSE’s *“Probability and Probability Models”* and ENS’s *“Stochastic Processes in Finance”* train students to quantify risk, price derivatives, and simulate market behaviors. - **Economic and Financial Theory**: Students engage deeply with modern portfolio theory, capital asset pricing, and monetary policy. EHESS’s *“Asset Pricing and Financial Markets”* offers a rigorous theoretical lens, equipping graduates to evaluate market efficiency and investor behavior.

- **Applied Financial Technologies**: Increasingly, programs incorporate fintech and data science. ENS’s focus on machine learning and algorithmic trading, alongside PSE’s use of real-time market data simulations, highlights the shift toward tech-driven finance practice. These pillars ensure that graduates are fluent in both classical financial principles and emerging innovations shaping the future of the sector.

Career Pathways: From Classroom to C-Suite

Successfully navigating PSE, EHESS, or ENS Finance degrees opens access to a spectrum of high-impact careers, each demanding distinct yet complementary skill sets. EHESS alumni frequently enter research-heavy roles—ranging academic economics to central banking—leveraging their analytical depth and theoretical agility. Graduates often secure positions at elite asset managers and consulting firms, where their ability to model complex financial systems is highly prized.PSE graduates, influenced by the program’s strong industry ties, often pursue careers in corporate finance and investment banking. The curriculum’s focus on valuation, risk analysis, and real financial markets prepares them for roles in M&A advisory, private equity, and structured finance. Many secure internships at institutions such as BNP Paribas or Rothschild & Co, accelerating rapid progression into high-level positions.

ENS Finance alumni frequently transition into quantitative roles, especially in fintech, algorithmic trading, and risk modeling. These data-savvy professionals thrive in environments where predictive analytics and machine learning optimize trading strategies and portfolio management. Their advanced technical background positions them as leaders in financial innovation, often collaborating with software engineers and data scientists at cutting-edge financial technology firms.

Salary Realities and Sector Demand

While salaries vary by specialization and experience level, early-career finance professionals from top French institutions command competitive starting packages, reflecting the high demand for advanced financial expertise. Junior analysts at investment banks or asset managers with PSE, EHESS, or ENS training typically see base salaries ranging from €45,000 to €65,000 annually, depending on location and sector. More senior roles—such as financial analyst, risk coordinator, or trading associate—can exceed €90,000, particularly in Paris, Lyon, or tech hubs like Marseille.> “Employers consistently highlight the analytical rigor and global perspective these programs provide,” says Claire Dubois, HR Director at a leading French asset manager. “Candidates from ENS Finance and EHESS stand out not just for their technical skills but for their ability to synthesize cross-disciplinary insights—precisely what we need in rapidly evolving markets.” Sector demand remains strong across banking, insurance, corporate finance, and emerging fintech. As digital transformation accelerates, roles integrating data science with finance are expanding fastest, with firms increasingly seeking candidates possessing blended expertise.

Strategic Fit: Choosing Between PSE, EHESS & ENS

Selecting among PSE, EHESS, and ENS Finance programs requires careful alignment with personal career goals, learning preferences, and long-term aspirations. EHESS appeals to those drawn to intellectual rigor and interdisciplinary research, offering a deeper theoretical foundation ideal for future economists, policymakers, or academic researchers. Its small cohorts and section-based learning foster close faculty mentorship and collaborative inquiry.PSE attracts students focused on applied finance—those seeking rapid entry into corporate finance roles with direct industry exposure. Its strong internship networks at major French financial institutions accelerate real-world onboarding and professional growth. ENS Finance stands out for graduates aspiring to dominate quantitative and tech-driven finance.

With integrated programming in data science and advanced mathematical modeling, ENS caters to future innovators in algorithmic trading, financial engineering, and big data analytics. Each institution’s unique profile ensures graduates are not just qualified—but differentiating.

Future Outlook: What’s Next for Finance Education & Career Paths

The convergence of financial complexity, technological disruption, and global economic shifts is reshaping how traditional finance degrees deliver value.PSE, EHESS, and ENS Finance programs are proactively evolving—incorporating AI literacy, sustainable finance, and behavioral economics into their core curricula. This forward-looking design ensures graduates enter a finance sector defined by innovation, regulatory change, and ethical scrutiny. Professionals emerging from these programs are not only skilled analysts—they are strategic thinkers equipped to navigate volatility, drive sustainable growth, and lead transformation across sectors.

As finance becomes ever more interdisciplinary, the distinction between economics, computer science, and management continues to blur—making elite training from PSE, EHESS, and ENS indispensable for those aiming to shape the future. In essence, decoding the PSE, EHESS, and ENS Finance degrees reveals more than course syllabi—they unveils a pipeline of leaders ready to dominate a dynamic, high-stakes financial world, one rigorous lecture, advanced model, and strategic insight at a time.

Related Post

Decoding PSEi, CSE, and Finance: How Data-Driven Insights Shape Modern Investment Decisions

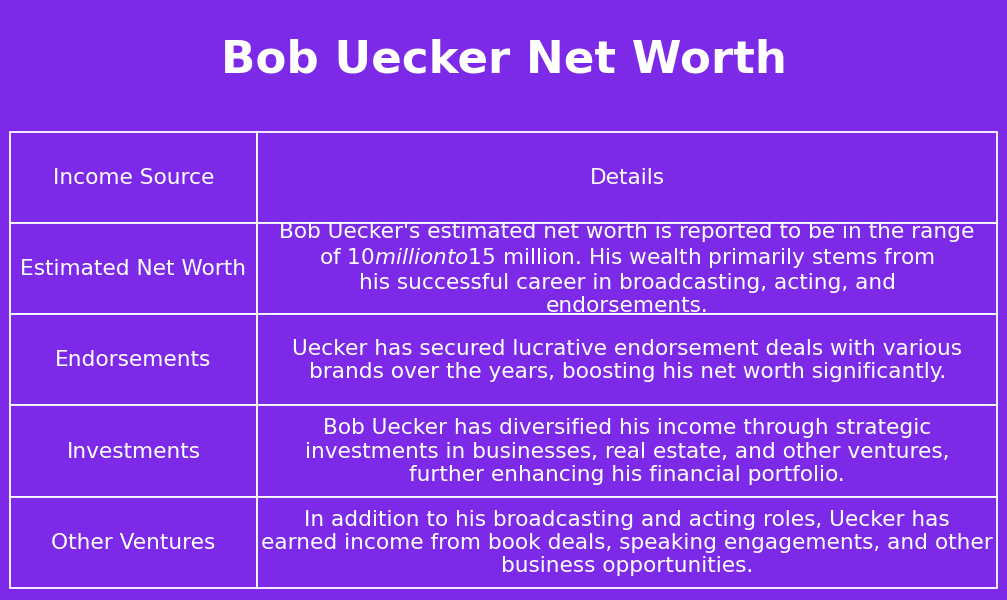

From the Green to the Golden: Unraveling the Net Worth of Bob Uecker

Merry Christmas, Styling the Season: How Font Choices Transform Festive Communication

The Compact Powerhouse of Apple’s iPhone 12 Mini: Sleek Design, Featherweight Performance, and Unmatched Value