Decode Brazil’s Tax Identity: Mastering the Format of CNPJ and CPF

Decode Brazil’s Tax Identity: Mastering the Format of CNPJ and CPF

In the complex landscape of Brazilian taxation, the National Register of Legal Entities (Receita Federal’s CNPJ) and Personal Identification Code (CPF) form the backbone of official identification for businesses and individuals alike. Understanding their distinct but interconnected formats is essential for compliance, verification, and operational efficiency. This article unravels the nuanced structures of Brazil’s key tax and identification identifiers, offering clear insights into their layout, purpose, and real-world application.

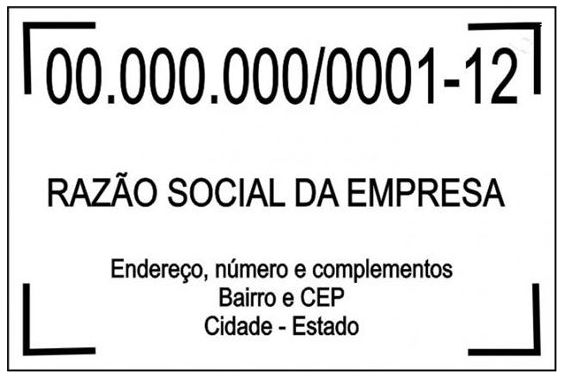

At the heart of Brazil’s tax system is the CNPJ — the razão social taxation identifier for corporations and legal entities—while the CPF serves as the personal identification code for natural persons. Both play critical roles in governmental and commercial transactions, enabling accurate reporting, auditing, and transaction integrity. Yet, each follows a precise, hierarchical format that reflects Brazil’s federal administrative logic.

Deciphering these formats transforms confusion into clarity, empowering companies, tax professionals, and citizens to navigate Brazil’s fiscal ecosystem with confidence.

Mastering the CNPJ: Brazil’s Mandatory Tax Identification Structure

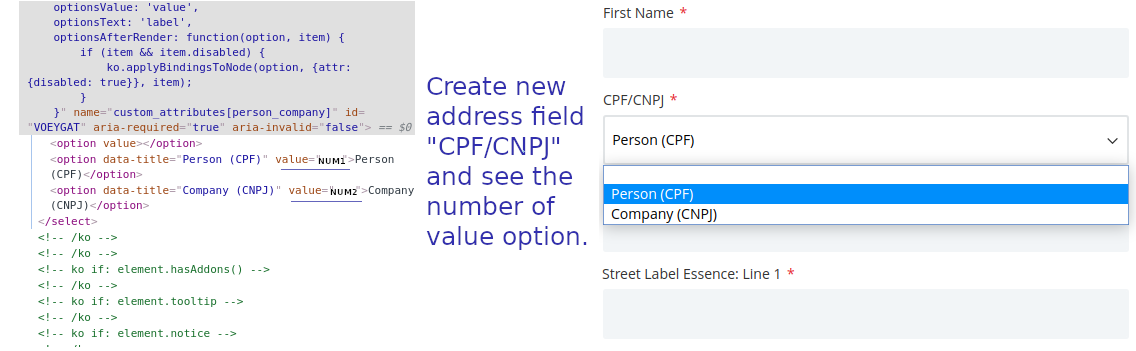

The CNPJ—short for “Cadastro Nacional da Pessoa Jurídica” (National Registry of Legal Entities—is a unique, state-issued identifier reserved exclusively for corporations, partnerships, and other legal business entities. Unlike personal IDs, the CNPJ is not numeric; it is an alphanumeric code governed by the Brazilian Receita Federal (Federal Revenue Service).The standard CNPJ format consists of 14 characters structured typically as:

- First 7 digits: An arbitrary sequence issued by Receita Federal.

- Next two digits: A control number, automatically generated but uniquely assigned.

- Last five digits: The entity’s actual alphanumeric registered code providing operational identification. Example of a valid CNPJ structure: 47.901.123-89 — where 47.901.123 is the registration code and 89 is the checksum.

- CNPJ Completo: Full format with registration and checksum digits.

- CNPJ Albo: Extended option allowing up to 20 characters, often used for auxiliary or legacy registrations.

- Número de Registro: Minimal 8-digit functional identifier, useful for internal tracking.

- Included exclusively within official federal tax documents and government databases.

- Leverage structured serialization to ensure verifiable uniqueness across all provinces.

- Integrated with digital platforms such as clarity.portal.rf.br for real-time validation.

- Comprises 11 digits, no letters or separators.

- Digits are uniformly selected from 0 to 9, generating a unique numeric signature.

- No central numeric allocation logic—unlike CNPJ’s algorithm-driven structure—but issued sequentially in registration batches.

- Public sector services such as tax filing, pension claims, and municipal registrations.

- Private sector applications including payroll verification and customer onboarding.

- Digital identity verification, where format precision ensures document authenticity.

Though format varies slightly by industry or federal state, the full 14-character sequence remains consistent across official documents.

Notably, CNPJs come in multiple variants, including:

“Avoid ambiguity—accuracy is non-negotiable.”

To aid clarity, CNPJ identifiers follow strict hierarchical rules:

CPF: Brazil’s Personal Identification Code and Its Format

While CNPJ governs legal entities, the CPF (Cadastro de Pessoas Físicas) serves as Brazil’s personal identification number for individuals. Intriguingly, unlike the CNPJ, the CPF is numerically formatted, though governed with equal systematization by the Receita Federal. It enables residents to open bank accounts, file taxes, access healthcare, and engage in official services.Understanding its 11-character structure is key to personal and professional compliance in Brazil.

Despite its numerical simplicity, the CPF follows a fixed schema:

Importantly, the CPF’s structure enforces anonymity at first registration.

“The initial eleven digits serve primarily as a unique identifier—shared among individuals without inherent meaning in the format itself,” explains Ana Costa, data privacy expert at the Brazilian Institute of Research in Law. “Only combined with state post codes and personal tokens does CPF become functionally traceable.”

CPF formatting differs significantly from CNPJ in both design and function. While CNPJ digits undergo algorithmic validation to ensure uniqueness, CPF digits are issued sequentially but subject to active monitoring for fraud—a system reinforced by Receita’s biometric and document verification protocols.

The CPF’s numeric, 11-digit format contrasts with the alphanumeric CNPJ, yet both systems rely on integrity mechanisms to prevent duplication. Regulatory oversight mandates strict formatting in all official channels, including payroll systems, government portals, and financial institutions. “When using CPF in digital agreements or dense data streams, maintaining format consistency is vital to avoid non-validation errors,” cautions Fernando Mendonça, cybersecurity advisor in Brazil’s financial sector.

“A misplaced zero or typo at the beginning renders the number invalid—immediately blocking access or triggering alerts.”

In everyday practice, CPF usage spans:

Titling CNPJ and CPF together reveals a dual identity system: one for corporate authority, one for personal legitimacy.

While CNPJ’s alphanumeric complexity reflects legal precision, CPF’s numeric uniformity embodies simplicity with built-in fraud resistance. Both formats operate under federal oversight, ensuring every identifier remains a verifiable, immutable checkpoint in Brazil’s public and private infrastructure. Understanding these structures is not just technical—it is essential for compliance, trust, and operational clarity in one of Latin America’s most dynamic economies.

Related Post

Unveiling the Truth Behind *Layangan Putus*: The Raw Stories of Mommy Asf in Novel Format

I'M In Love With The Villainess Manga Free Online — Why This Dark Classics Deserves Its Fanbase

Altitude Mexico DFS: Soaring Above the Ordinary in Global Aviation

From Humble Beginnings to Billion-Dollar Vision: The Rise of Luigi Ws — The Bright Kid Who Redefineds Entrepreneurship