Debt Relief That Works: Mastering First Advantage Debt Relief with Clarity and Confidence

Debt Relief That Works: Mastering First Advantage Debt Relief with Clarity and Confidence

For millions burdened by financial strain, navigating debt can feel overwhelming—especially when traditional paths to relief seem slow, complex, or insufficient. The First Advantage Debt Relief program has emerged as a fresh, practical alternative, designed to cut through the confusion and deliver actionable solutions. This in-depth guide unpacks how First Advantage Debt Relief functions, who qualifies, its core benefits, and the steps to begin recovery—providing a clear roadmap for those seeking sustainable financial freedom.

At its core, First Advantage Debt Relief is a structured, debt-focused program aimed at accelerating the debt repayment journey by combining personalized financial counseling with strategic debt modification and repayment planning. Unlike rigid credit counseling or generic debt management plans, this approach tailors solutions to individual circumstances, emphasizing transparency, affordability, and real progress. By blending expert guidance with practical tools, the program empowers borrowers to regain control over their financial lives efficiently.

How First Advantage Debt Relief Operates: A Step-by-Step Breakdown

The First Advantage Debt Relief model functions through several key stages: initial assessment, plan customization, professional advocacy, and ongoing support.Each phase is designed to remove common barriers to debt elimination.

First, borrowers undergo a confidential financial evaluation, where income, expenses, and existing obligations are analyzed to build a clear picture of financial health. This assessment forms the foundation for crafting a personalized repayment strategy—often involving debt consolidation, renegotiated terms, or structured payment pathways that reflect realistic income capacity.

Critical to the process is the role of financial advisors trained to advocate on behalf of clients, leveraging institutional relationships to secure better rates and conditions.

- **Debt Profiling:** A detailed inventory of all debts—credit cards, medical bills, personal loans—with interest rates, balances, and current payments. - **Customized Roadmap:** A tailored plan that adjusts monthly payments based on cash flow, protects urgent needs, and prioritizes high-interest liabilities. - **Lender Negotiation:** Direct engagement with creditors, often resulting in reduced interest rates, waived fees, or extended repayment windows.- **Ongoing Support:** Access to financial coaches who monitor progress, refine strategies, and adjust plans as life circumstances change.

This multi-layered approach ensures that debt relief isn’t just a temporary fix but a sustainable process, grounded in data and responsive to real-world challenges.

Who Qualifies for First Advantage Debt Relief? Key Eligibility Criteria

Not every debtor is a fit for every relief program, and First Advantage Debt Relief implements clear, realistic eligibility standards to ensure both client suitability and program effectiveness.Primary qualifications include:

- Current Debt Load: Borrowers must have outstanding debt across consumer or medical credit accounts.

- Stable Income: A steady paycheck or verified income source to support repayment without financial overextension.

- Financial Responsibility: Willingness to engage with advisors, attend sessions, and adhere to updated budgets.

- Legal Clearance: No active bankruptcy filings or legal encumbrances preventing repayment agreements.

Importantly, the program recognizes that financial hardship is diverse—whether stemming from medical crises, job loss, or overleveraged purchases—making flexibility in eligibility favorable for a broad range of individuals seeking reprieve.

Core Advantages: Why First Advantage Stands Out in Debt Relief

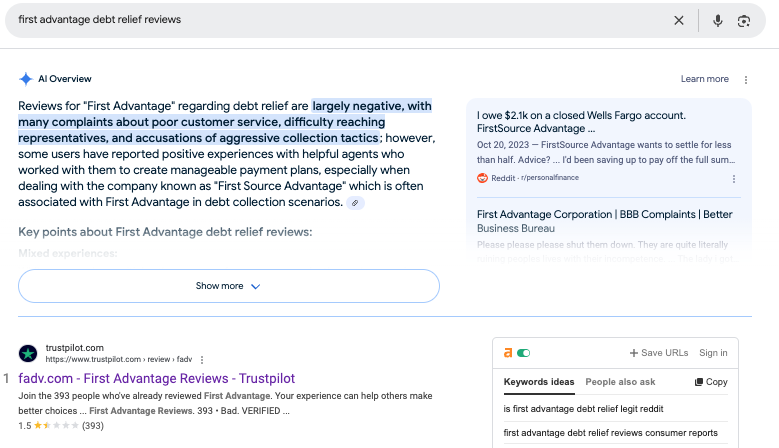

Among the crowded debt relief landscape, First Advantage Debt Relief distinguishes itself through transparency, dedicated support, and measurable results. Unlike high-pressure sales models or one-size-fits-all solutions, this program emphasizes honest conversations about long-term sustainability.Key benefits include:

- No Hidden Fees: Essential costs are clearly disclosed upfront; the focus remains on reducing principal, not generating profit through fees.

- Personalized Counseling: Each client works with a dedicated advisor specializing in financial recovery, offering tailored strategies and emotional support.

- Proven Track Record: Independent verification of success rates and repayment progress builds trust and accountability.

- Client Empowerment: Beyond relief, the program educates on budgeting, credit rebuilding, and financial literacy to prevent future debt cycles.

“What sets First Advantage apart is not just lowering monthly payments—but helping people truly understand and manage their finances moving forward,”said Sarah M.

L., a program participant who reduced $71,000 in debt over 24 months. “It’s about lasting change, not just short-term fixes.”

From rapid initial progress to long-term financial resilience, the program’s structured yet adaptable framework responds to real needs without compromising dignity or transparency.

Step-by-Step Process: Starting Your Journey with First Advantage Debt Relief

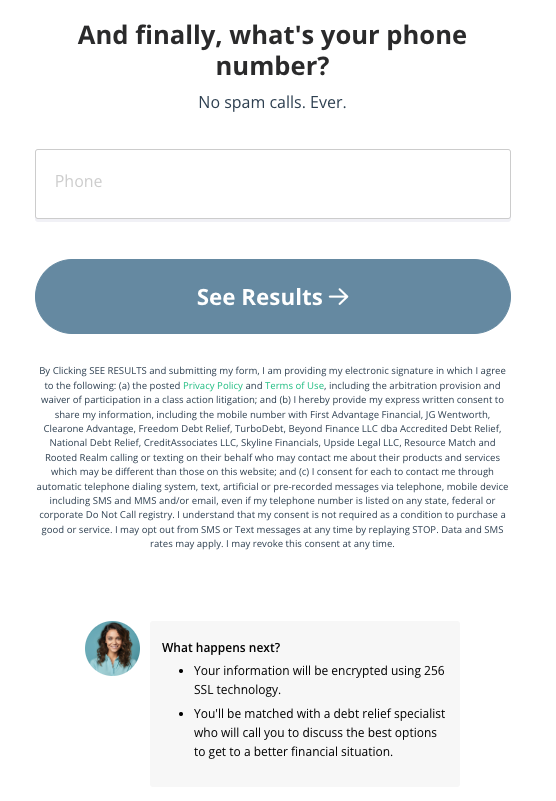

Engaging with First Advantage Debt Relief follows a straightforward sequence designed to maximize clarity and action. Understanding each phase helps manage expectations and encourages proactive participation.1. **Initial Inquiry & Assessment** Start with a confidential financial check-in, where clinics or online tools gather data on debts, income, and obligations. This sets the stage for a customized plan.

2. **Custom Plan Development** Advisors collaborate with clients to design a repayment schedule balancing affordability and speed, often involving creditor negotiations to improve terms. 3.

**Formal Agreement & Onboarding** Borrowers sign a binding agreement outlining payments, reduced rates, and support mechanisms—ensuring sustainability and accountability. 4. **Active Repayment & Coaching** Monthly payments begin, paired with ongoing coaching to adjust strategies as life circumstances evolve—keeping momentum steady.

5. **Ongoing Support & Monitoring** Even after formal repayment concludes, clients retain access to advice for financial maintenance and credit repair guidance.

Wait times for initial assessments average 3–5 business days, and plan activation follows immediately—making timely relief accessible when urgency is greatest.

The Endgame: Debt Relief as a Catalyst for Financial Freedom

First Advantage Debt Relief is more than a program—it’s a transformative pathway from spiraling debt to sustainable stability.By combining rigorous planning, dedicated advocacy, and holistic financial education, it addresses not only numbers on a ledger but the psychological and practical burdens that accompany financial hardship. For those navigating overwhelming bills, the path forward is clearer than ever: assessing needs, committing to process, and leveraging expert support to build real, lasting change. In doing so, individuals regain more than financial breathing room—they reclaim control over their lives, setting the foundation for long-term security and peace of mind.

Related Post

Is Jim Cramer a Republican or Democrat? Unpacking the Political Leanings Behind the CNBC Host’s Media Persona

Top Android Games Your Ultimate Guide: Elevate Your Mobile Gaming Experience

Palace Confirms Baby Number 4: Joyful News Sparks Royal Family Euphoria

Unveiling The Life Of Larry Fink’s Daughter: A Journey Beyond The Spotlight