Chasing Turbulence: Decoding China’s Economic Oscillations Amid Racing News and Shifting Policies

Chasing Turbulence: Decoding China’s Economic Oscillations Amid Racing News and Shifting Policies

China’s economy continues its signature dance of booms and reprieves, marked by pronounced oscillations that reflect deep structural shifts, global pressures, and volatile domestic stimulus. Over the past decade, the country has swung from high-speed growth to cautious restructuring, driven by both internal transforming forces and external shocks. Recent news—from property sector crises to tightening credit lines and fluctuating export data—illuminates a complex pattern of resilience and recalibration.

This article unpacks the key drivers behind China’s economic oscillations, analyzes recent developments, and assesses their broader implications for markets and policy-makers.

At the heart of China’s economic volatility lies a structural transformation away from investment-led expansion toward consumption and innovation-driven growth. For years, state-led infrastructure spending and credit expansion propelled double-digit GDP growth, but rising debt levels and shrinking productivity growth have forced a strategic pivot.

“The era of easy growth is over,” notes economist Wu Jinglian, “China must now deepen reforms to unlock sustainable expansion.” This transition has not been smooth—sudden property market collapses, surfacing liquidity issues, and declining consumer confidence punctuate the journey, revealing both progress and fragility.

Recent data underscores the cyclical nature of China’s economy. According to the National Bureau of Statistics, GDP growth slowed to 5.2% in 2023—the lowest in nearly three decades—amid weakening exports, soft private investment, and a decade-long property downturn.

“2030 might be our new baseline,” observes a leading macroeconomic analyst, “not a resurgence year, but one of recalibrated expectations.” The property sector, once a pillar of growth contributing up to 25% of GDP, now faces deleveraging and storefront vacancies. Iconic developments like Shanghai’s underoccupied skyscrapers and lagging home sales highlight the ripple effects across construction, banking, and local government revenues.

-The rhythm of booms and contractions in China’s economy is heavily influenced by cyclical policy interventions, often reactive rather than preemptive.

Since 2023, Beijing has deployed a mix of credit easing and targeted fiscal support—important battlegrounds in taming oscillations. The People’s Bank of China (PBoC) cut agricultural loans and reserve requirement ratios to inject liquidity, aiming to boost small business and household spending. Yet experts caution that such measures remain incremental against the scale of structural challenges.

“Monetary tools are blunt when wavelengths shift,” critiques Liu Wei, a senior researcher at Tsinghua University. “Fiscal policy and institutional reforms must accelerate to stabilize the cycle.”

Compounding the adjustments is China’s evolving trade posture amid escalating U.S.-China tensions and global supply chain reconfiguration. Exports, historically a key growth lever,面临 structural headwinds from saturated markets and shifting demand, particularly in electronics and machinery.

“China’s export engine is slowing, but innovation and domestic reform could build new momentum,” explains trade analyst Zhao Ming. Recent shifts toward self-reliance in semiconductors and green energy reflect strategic efforts to reduce external vulnerability and rebalance growth drivers.

Recent news paints a mixed picture of recovery and risk.

The December 2024 data revealed modest derivatives market gains, signaling cautious investor optimism, yet government statistics confirm persistent headwinds: youth unemployment exceeds 21%, and consuming confidence remains subdued. Breakdowns in key sectors—sharp drops in private fixed asset investment (-12% YoY in November)—underscore vulnerability in private sector dynamism. Meanwhile, acoustic monitoring of city activity and logistics volumes points to uneven recovery patterns across regions, with inland provinces lagging behind coastal metropolises.

What defines China’s current economic pulse? Three interlocking dynamics: structural transition, policy responsiveness, and external volatility. While uncertainty lingers, there is growing consensus that sustainability—not speed—now defines the country’s growth narrative.

“The next cycle won’t be about rapid expansion, but gradual resilience,” articulates an official from the National Development and Reform Commission. This cautious recalibration suggests longer-term stability over short-term spikes.

The trajectory of China’s economic oscillations mirrors not just national adjustments but global interdependence.

From commodity flows to financial contagion, ripples from Beijing shape—and are shaped by—world markets. As the economy navigates a terrain of managed volatility, policy credibility, structural reform, and external adaptation remain critical. For investors, businesses, and policymakers, understanding this oscillating rhythm—not as chaos, but as evolution—is essential.

In a world of unpredictable swings, China’s capacity to self-correct, reform, and reinvent will determine whether turbulence evolves into long-term renewal or indefinite plateauing. The dance continues—once defined by momentum, now by insight and adaptation.

Related Post

How Old Is Lauren Shehadi? Unveiling the Age of the Rising Star

How Rich Is Ozzy Osbourne? Exploring The Wealth Of The Prince Of Darkness

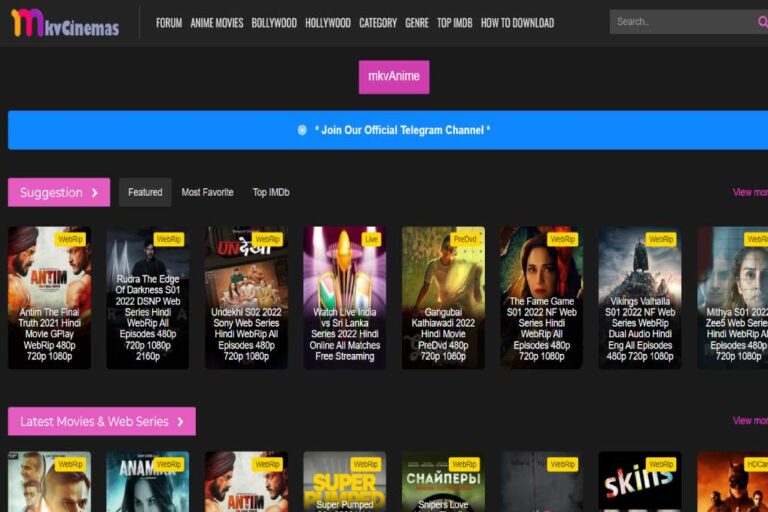

Your Ultimate Guide to Streaming Movies with MKVCinemas: Where Cinema Never Ends at Home

Roblox Assist Id: The Hidden Key to Smarter Automation for Modern Game Creators