Chase Mobile App: Your Bank On The Go — All You Need to Know for Seamless Banking on iOS

Chase Mobile App: Your Bank On The Go — All You Need to Know for Seamless Banking on iOS

Staying ahead in today’s fast-paced world demands financial control, and the Chase Mobile App delivers—right from your iPhone’s fingertips. With intuitive navigation, real-time alerts, and powerful tools integrated into one platform, Chase transforms the Chase Mobile App into more than a digital wallet—it becomes your 24/7 financial command center. Designed specifically for iOS users, this app enables everything from instant fund transfers and bill payments to budget tracking and credit monitoring, all while maintaining the highest standards of security and usability.

Whether you’re managing paychecks in a café or reviewing your monthly spending after a busy week, the app empowers users to act quickly, confidently, and securely—right where they are.

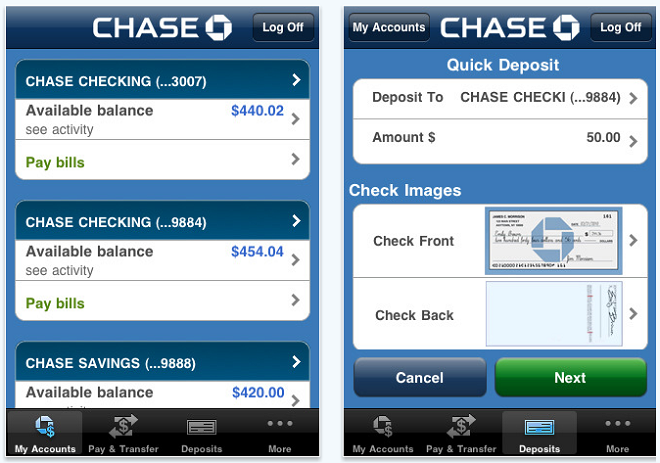

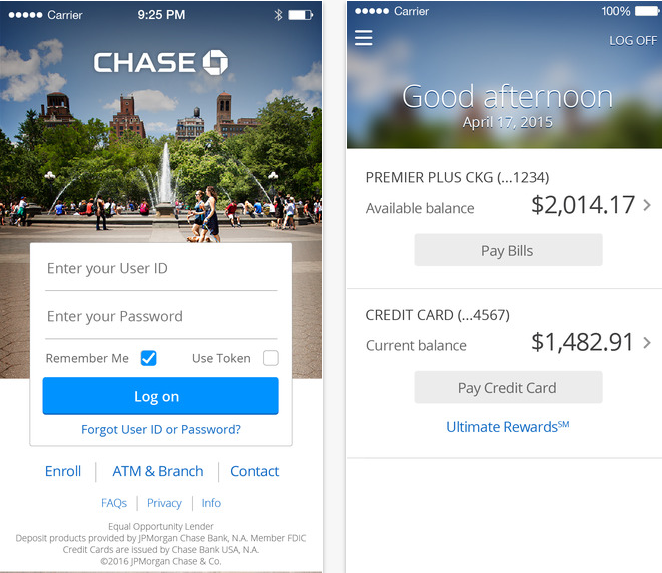

The Chase Mobile App for iOS stands out as a cornerstone of modern banking, offering a comprehensive suite of features built to fit the rhythms of modern life. From the moment you open the app, you’re greeted with a clean, customizable dashboard that surfaces your most relevant financial data—account balances, recent transactions, and upcoming payments—within seconds.

“The app was built with real users in mind,” says Sarah Kim, a customer experience analyst specializing in fintech interfaces. “It balances simplicity with depth, so you’re never overwhelmed yet always in control.”

Real-Time Access When Every Second Counts

One of the app’s most impactful strengths is its real-time transaction monitoring. Chase Mobile instantly pushes notifications for deposits, withdrawals, and purchases, enabling users to detect unusual activity and respond before issues escalate.For frequent travelers or professionals on the move, the app supports automatic currency conversion and international transfer status checks, vital for keeping cross-border finances transparent. The ability to initiate peer-to-peer payments, transfer funds between Chase accounts, or send temporary access to a bill payee directly from the home screen eliminates the need for costly and time-consuming bank visits or calls.

Equally valuable is the app’s support for dynamic budgeting tools.

Users can set custom spending limits, categorize expenses, and receive push alerts when nearing thresholds—transforming passive banking into a proactive financial management experience. These features are especially impactful for new graduates, freelancers, and small business owners who often juggle fluctuating income and tight cash flow. The app’s adaptive interface learns from user behavior, showing tailored insights that prompt smarter decisions without cluttering the interface.

Security Built into Every Layer

Security remains paramount in digital banking, and Chase Mobile App delivers robust protection that evolves with emerging threats.Biometric authentication—Face ID and Touch ID—ensures secure logins, while end-to-end encryption safeguards data from sender to receiver. The app also integrates Chase’s Cash Secure® technology, offering instant zero-liability payee protection for mobile payments and a discreet card verification method that keeps sensitive information safe. Regular system updates patch vulnerabilities before they can be exploited, giving users peace of mind with every tap.

For added vigilance, users receive proactive alerts for suspicious login attempts or anomalous transaction patterns, turning every device into a guarded financial vault.

Financial inclusion and accessibility are woven into the Chase Mobile App’s design, ensuring users across devices and abilities can manage their money with confidence. With VoiceOver compatibility and intuitive gestures, the interface aligns with accessibility standards, making banking inclusive and intuitive for everyone.

Additionally, offline transaction recording continues to work even without connectivity—steps are automatically saved and synced once the connection is restored, so spontaneity doesn’t mean risk.

Integrations and Personal Finance Tools That Grow With You

Beyond basic banking, the Chase Mobile App integrates seamlessly with third-party services and Chase’s broader financial ecosystem. Seamless linking of miles, rewards programs, and investment accounts enriches user engagement, turning routine checks into opportunities to maximize value. Whether tracking travel points, redeeming cashback, or monitoring retirement balances, these integrations create a holistic view of personal wealth.The app’s portfolio and credit tools are designed for clarity, offering real-time score updates, savings goal trackers, and automated alerts that help users build stability. With offline reading and paperless statements, managing finances digitally becomes effortless—without sacrificing depth or control.

One of the most underrated features is Chase Mobile’s AI-driven support ecosystem.

Chatbots and virtual assistants answer routine questions instantly, while human support is just a tap away when complex issues arise. This blend of technology and personal care ensures users never feel isolated in their financial journey. Feedback from users consistently highlights the app’s reliability: “It’s like having a personal banker in my pocket—always available, always helpful,” noted a frequent user in a recent app review.

The ecosystem evolves accordingly, with updates expanding functionality based on real-world usage patterns and customer needs.

Empowering Financial Independence from Your Apple Device

For iOS users, the Chase Mobile App transcends traditional banking—serving as a dynamic partner in financial empowerment. From instant payments and real-time insights to robust security and inclusive design, every feature is engineered to support control, clarity, and confidence

Related Post

Unlocking Bladder Secrets: How Urinary Tract Labeling Revolutionizes Clinical Diagnosis

Parking Fury Unblocked: Mastering Urban Mobility in a Parking-Challenged World

Unraveling The Mystery Of Tim Henson's Wife: The Quiet Power Behind The Henson Legacy

Ninjago Lego Movie Cast: A Heroic Cosmic Ensemble That Lighted a billion Screens