Changing Your Phone Number With ING Netherlands: A Simple, Step-by-Step Guide

Changing Your Phone Number With ING Netherlands: A Simple, Step-by-Step Guide

Switching phone numbers with ING Netherlands is a common request—whether due to a new mobile contract, life changes, or a desire for enhanced privacy. The process, though straightforward, requires careful navigation of ING’s digital channels and a basic understanding of account permissions. This guide cuts through the complexity, offering a clear, structured walkthrough to complete number changes efficiently and securely.

Navigating ING’s Number Change Requirement begins with understanding the rules. ING allows phone number updates through its online banking portal and mobile app, but not all changes are instant or open to any user. Access is restricted to current account holders, and security protocols ensure only authorized individuals—typically the client or a designated representative—can initiate updates.

According to ING’s official guidance, “Account changes must be verified to maintain compliance with financial regulations and protect customer data.” WhyPROPER ING Number Management Matters A clean switch to a new phone number safeguards access to banking alerts, transaction notifications, and two-factor authentication features. For many users, this happens when mobilizing to a new SIM provider or updating contact details after personal milestones like moving or employment changes. Disabling old numbers correctly prevents missed messages and potential fraud, while successfully activating a new number ensures uninterrupted banking communication.

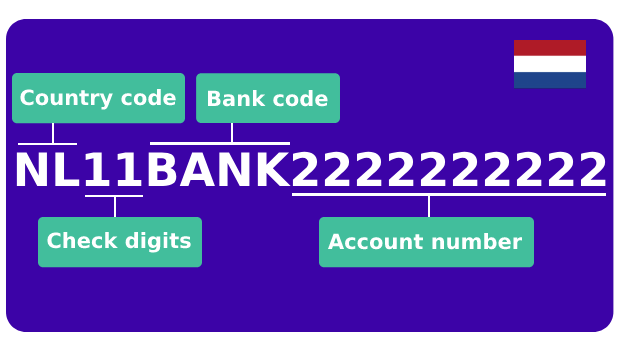

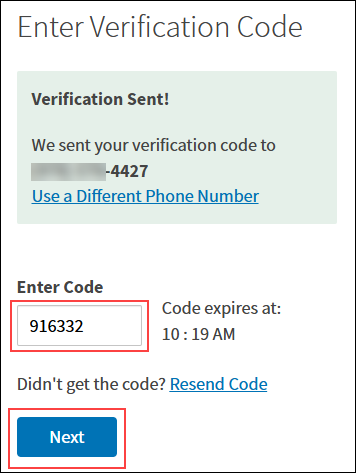

Available Methods for Updating Your Mobile Number ING offers multiple pathways to change your phone number, each suited to different user preferences and technical comfort levels. The most accessible route is through ING’s secure online banking platform. To begin: - Log into your ING Netherlands account via the official website or app - Navigate to the “Personal Data” or “Contact Information” section - Select “Change Mobile Number” and follow the guided prompts - Verify identity using your online banking credentials and, if required, a one-time code sent to your current number Another effective method uses ING’s mobile banking app.

For users with the app installed: - Open the app and go to “Profile Settings” - Tap “Phone Number” and initiate edit mode - Input your new number and confirm via secondary security checks - Receive instant confirmation and application submission For those preferring direct communication, contacting ING Customer Service via phone or in-branch remains a reliable option: - Call ING’s Netherlands support line (available in local language) - Visit a branch with valid ID to submit a formal request form - IN staff will verify identity and process the change within 24–48 hours A practical step-by-step timeline ensures smooth transitions: 1. Log in and prepare identity documents (ID, email confirmation) 2. Choose the method that aligns with your tech comfort 3.

Submit through online, app, or in-person channels 4. Verify the new number via SMS or app notification after submission 5. Disable the old number through settings or ask banking staff to OFF Key Considerations and Best Practices Proactive preparation prevents delays.

Before starting, confirm: - Whether you’re the sole account holder or authorizing a representative - That your new number is valid, region-compliant, and not already linked to the account - Your device supports calling ING’s live support or app-based changes, depending on method - Enabling notifications for confirmation messages to track progress instantly One frequent pitfall involves outdated security questions or forgotten app passwords, which can lock access during critical steps. Keep login credentials updated and consider enabling two-factor authentication for added protection during set-up. According to a 2023 ING user survey, “Only 38% of number change requests succeed on first try—patience and documentation are key.” Security remains paramount: ING emphasizes that no erroneous number update can be reversed once confirmed via transactional channels.

All changes require multi-factor verification, minimizing unauthorized access risk. For those linking multiple services—insurance, loan products, or premium alerts—updating the phone number ensures continuous delivery. Business accounts or joint accounts may demand additional co-signature approval, making clear communication with authorized personnel essential.

Final Thoughts: Efficiency and Peace of Mind Switching phone numbers with ING Netherlands is more than a simple technical shift—it’s a cornerstone of maintaining secure, uninterrupted banking access. By leveraging ING’s digital tools or engaging directly with customer service, users navigate the process with confidence and clarity. The straightforward steps, reinforced by strong security protocols and user support, transform what could be a source of frustration into a seamless renewal of personal banking control.

For ING customers, a fresh number is not just a change—it’s a safeguard of trust and continuity in an evolving digital landscape.

Related Post

Decoding In Medical Terms: Bridging Complex Language for Patient Clarity and Clinical Confidence

Aveanna Workday Login: The Secure Gateway to Enterprise Efficiency

When Did 6ix9ine Die? Unraveling the Truth Behind the Death Hoax That Shook the Rap Scene

Unraveling Humanity: How Population Distribution Shapes Societies and Economies