Buying Duty-Free Cigarettes In South Africa: Your Ultimate Guide

Buying Duty-Free Cigarettes In South Africa: Your Ultimate Guide

For many travelers visiting South Africa, securing duty-free cigarettes is a top priority—but navigating the rules, costs, and practicalities can be complex. This definitive guide breaks down everything you need to know about purchasing duty-free tobacco products in the country, from legal limitations and tax implications to trusted retailers, cost savings, and emerging digital trends. Whether you're a first-time visitor or a seasoned traveler, understanding the nuances ensures compliance, maximizes savings, and avoids costly surprises at customs.

Navigating the Legal Landscape of Duty-Free Cigarettes in South Africa

South Africa imposes some of the world’s highest tobacco taxes to curb smoking rates and generate revenue.

As a result, buying duty-free cigarettes within the country is both regulated and restricted. Tourism tax (7%) and excise duties (over 100%) make local cigarette prices significantly higher than in many neighboring nations—driving demand for duty-free options. However, importation and duty-free sales are tightly controlled: only tax-exempt cigarettes brought *into* the country via specific channels qualify as truly duty-free.

“Visitors must ensure their purchases come through licensed duty-free outlets or pre-clearance mechanisms,” warns a senior customs official. These items are generally unrestricted for tourists older than 18, but minors face strict penalties. The rationale behind strict regulation reflects public health goals—limiting easy access to cheaper tobacco products.

Where to Legally Buy Duty-Free Cigarettes: Trusted Retailers & Locations

South Africa’s major airports serve as the primary gateways for duty-free cigarettes, offering a range of premium, imported brands at transparent prices.

Key locations include:

- OR Tambo International Airport (JNB): The largest and most accessible duty-free zone, operating under the South African Revenue Service (SARS) framework, selling global favorites like Drew, Marlboro, and Despite with upfront tax visibility.

- Cape Town International Airport: Offers a compact but well-stocked duty-free section, particularly popular among European and regional travelers, with a curated selection emphasizing premium and specialty brands.

- Port of Durban & East London Airports: Smaller duty-free kiosks serve freight and select retail outlets, though stock is limited and subject to strict import compliance.

- Verify Licensing: Always raid the SARS-licensed duty-free section—look for official logos and tax breakdowns.

Avoid informal or unbranded stalls near terminals.

- Estimate Early: Use online pricing tools to project final costs including taxes. Factor in a 5–10% buffer for unlisted fees.

- Timing Matters: Purchase midweek when outlets reduce markups by up to 5% compared to weekend surcharges. Avoid peak holiday surges.

- Check Personal Limits: Each adult may only bring up to 200 grams duty-free; minors are banned from purchasing.

Stay within legal boundaries.

- Leverage Digital Tools: Some retailers offer mobile apps or SMS confirmations for tax transparency—ideal for audit-ready records.

Outside airports, licensed duty-free shops operate in select hotel chains (e.g., Hilton, Protea Hotels) and select high-end retail hubs in principali cities. It’s essential to verify that any outlet is officially licensed—purchases outside regulated channels risk penalties or product invalidation.

How Much Do Duty-Free Cigarettes Cost? Comparing Prices and Hidden Fees

While duty-free labels promise tax-free savings, real-world pricing requires closer look.

A standard 20-mass pack of a mid-tier brand like Marlboro Ultra might retail between R450–R700 locally, but duty-free imports often include transparent, legally disclosed taxes—typically 7% tourism tax plus excise duty. Some retailers apply a small handling fee (R10–R30), clarified in pre-purchase breakdowns. A full pack of premium international brands can exceed R1,000 at retail outlets but may land at near-wholesale duty-free prices (~R700–R800) when properly declared.

“What travelers often overlook is that SARS tracks all duty-free sales—missing taxes can trigger customs audits,” cautions a licensed tobacco exporter. In contrast, buying locally without these fractions results in *higher* total costs when factoring in escalating taxes and limited selection. The real savings emerge only through authorized channels with full tax disclosure.

Smart Tips: Maximizing Savings on Duty-Free Tobacco Purchases

To both comply and save, travelers should adopt strategic habits:

The Hidden Risks: Customs, Penalties, and Compliance Pitfalls

Despite careful preparation, mistakes occur. Misdeclaring quantities, purchasing from unlicensed vendors, or smuggling cigarettes can lead to severe consequences. Upon detection, penalties include fines up to R20,000, confiscation of 50% of the cargo, and future travel bans.

At customs, officials employ muscle cars and scanners to detect undeclared tobacco, making pre-purchase honesty non-negotiable. “Tourists often underestimate that duty-free isn’t a loophole—it’s a licensed privilege,” warns customs liaison officer Thandiwe Nkosi. Travelers unknowing of these rules risk not just fines, but travel disruptions and compromised future access.

Emerging Trends: Digital Privacy and the Future of Duty-Free Tobacco Retail

As South Africa embraces digital transformation, duty-free operators are integrating secure, compliance-first technologies.

Mobile apps now allow users to pre-book tax-disclosed shipments online, receive real-time duty breakdowns, and generate digital compliance receipts—streamlining both purchase and customs clearance. Blockchain pilots are testing product traceability from factory to consumer, enhancing anti-smuggling efforts. Meanwhile, growing consumer demand for transparency pushes retailers toward full disclosure, reducing gray-market risks.

“The future favors travelers who trust the official, tracked channel,” notes industry analyst Mark van der Merwe. As regulations evolve, digital literacy becomes another layer of savvy travel preparation.

In essence, buying duty-free cigarettes in South Africa demands awareness, planning, and respect for the legal framework. When done right—through licensed outlets, clear pricing, and compliance—the process unlocks genuine value, saving both money and time.

For savvy travelers, the duty-free gateway isn’t just about lower prices… it’s about smarter, stress-free purchasing in a high-stakes environment.

Related Post

Baby Turtle Name: A Tiny Soul Defying Time in Azure Currents

Isle of Wight Bay: Nature’s Masterpiece Nested in Maryland’s Coastal Embrace

Anderson Silva’s Height and Reach: The Measurable Edge in MMA History

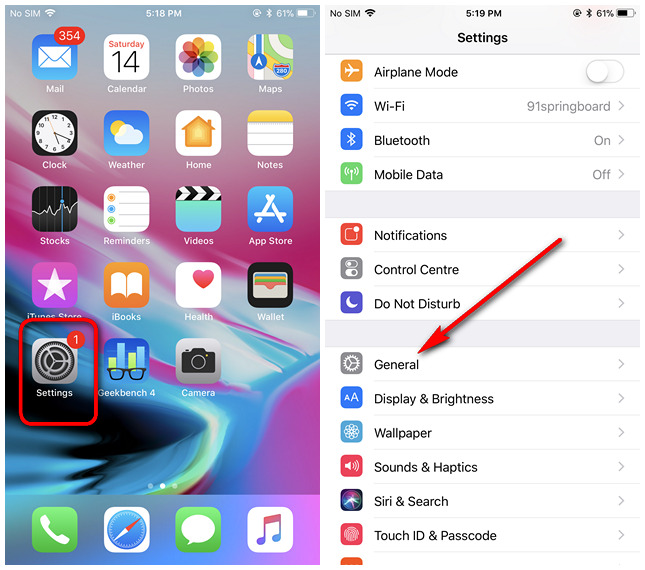

How to Turn Off Your iPhone Without Looking: Power It Down from Silence