Bonds Broken Bonds Formed: The Shockwaves When Market Trust Collapses

Bonds Broken Bonds Formed: The Shockwaves When Market Trust Collapses

In a financial ecosystem built on promises and contractual obligations, the breaking of bonds—when issuers default, ratings fall, and credit contracts fracture—is not just a risk, but a recurring catalyst of upheaval. The formation of broken bonds reflects more than isolated defaults; it signals systemic stress, erodes investor confidence, and reshapes capital markets. From corporate defaults during economic downturns to sovereign debt restructuring in emerging economies, the moment a bond ceases to reflect its original commitment marks a pivotal shift in financial trust.

These events ripple across portfolios, trigger volatility, and often form the foundation of new market paradigms. Understanding how bonds are broken—and what forms emerge from that rupture—offers critical insight into the fragility and resilience of global financing systems. The mechanics behind bond defaults are neither simple nor uniform.

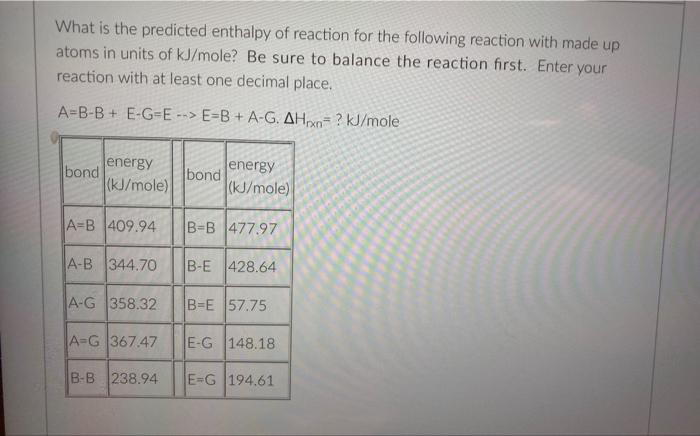

A bond may “break” in several distinct ways: payment suspension, covenant breach, rating downgrade, or outright write-down by holders. Each rupture follows legal, market-driven, or structural triggers. Payment suspensions, for instance, are often reactive, occurring when cash flow crises prevent timely interest or principal payments.

In contrast, covenant breaches—provisions embedded in bond agreements—can initiate defaults even before a full payment failure, when issuers miss financial or operational thresholds. “A single covenant snap can unlock a cascade of consequences,” notes financial analyst Dr. Elena Torres.

“Ratings agencies respond in real time, downgrading bonds and prompting institutional sell-offs—turning technical defaults into market-wide eventbolves.” Formation of “broken bonds” typically follows prolonged stress. Market participants monitor a range of signals: credit spreads widening, declining liquidity, and increased volatility around bond prices. When Azion Capital faced collapse in 2021, months before its formal default, credit metrics had already deteriorated—default swaps spiked, liquidity vanished, and trading fell to a whisper.

By then, investors were preparing for inevitable bond rupture. Broken bonds are not merely frozen contracts—they evolve into distinct financial assets: distressed debt, credit derivatives, or auction-prone instruments. Their transformation hinges on legal recovery processes, negotiation frameworks, and whether restructuring offers viable paths forward.

In defaults involving sovereign entities, such as Argentina’s multiple restructurings, the formation process involves complex multilateral negotiations, often leading to choreographed debt swaps rather than clean paper transfers. The aftermath of bond formation breakdowns reveals a layered recovery landscape. Broken bonds, once liabilities, become instruments of strategic reinvention.

Investors weigh burn risk against potential upside, often buying at deep discounts and holding for years. “The beauty of broken bonds lies in their asymmetry,” explains portfolio manager Rajiv Mehta. “While the probability of total loss remains high, structural changes—credit downgrades, maturity resets, or currency devaluations—can reset valuations, creating rare opportunities.” This environment rewards patience and deep analysis, demanding precise timing amid uncertainty.

Notable case studies underscore the varied evolution of broken bonds. In 2020, during the pandemic-induced market freeze, energy sector bonds in North America experienced cascading defaults. Several oil and gas firms invoked bankruptcy protections, rendering their bonds legally unenforceable under Chapter 11.

Yet, many were restructured through out-of-court deals, emerging with lighter debt burdens but tainted credit. Conversely, Argentina’s sovereign bond saga spans decades: defaults in 2001, 2005, 2010, and 2020 formed a fractured, multi-tier structure—holders holding held-out tranches, each restructuring sparking litigation and arbitration. “Every default bond becomes a legal labyrinth,” Mehta observes.

“Their transformation from uncollectible notes to negotiable securities demands expertise as much as capital.” Technological and regulatory changes now influence how broken bonds are formed and managed. Electronic trading platforms accelerate price discovery, while standardized nj’go protocols enhance transparency in restructuring negotiations. Regulatory reforms in jurisdictions like the U.S.

and EU aim to streamline insolvency procedures, reducing ambiguity around bondholder rights. Yet, complexity persists; even with improved systems, the moment a bond “breaks” often reveals systemic gaps—whether in contract clarity or enforcement mechanisms—that continue to test market resilience. Bonds broken under pressure are not humble failures—they are crucibles of reinvention.

The formation of broken bonds illuminates risks but also unveils opportunities embedded in market dislocation. Investors, legal experts, and policymakers navigate a terrain where asymmetric information meets asymmetric opportunity, balancing caution with the allure of asymmetric return. Far from endpoints, these ruptures form blueprints for adaptive finance—reminding stakeholders that even in collapse, structure evolves.

As markets absorb new defaults, the lessons crystallize: bonds may break, but the system endures—transformed, recalibrated, and ready to contract anew.

Related Post

IAcademy: Mastering the Crossroads of Politics and Business in Today’s High-Stakes Arena

Mark Sloan Redefines Modern Leadership Through Discipline, Data, and Disruption

Ari Kytsya’s Starbucks Video Sparks Voice of a Generation in Coffee Culture

Unlock Car Financing Hands-Free: Your Guide to Capital One Auto Finance Phone Support