Behind the Red: Inside the Daily Life of an Income Tax Officer Like Amay Patnaik

Behind the Red: Inside the Daily Life of an Income Tax Officer Like Amay Patnaik

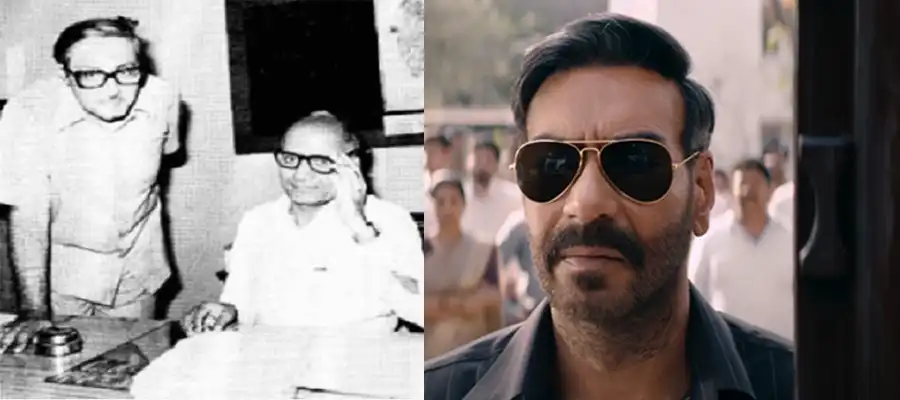

In the quiet hum of revenue departments across India, one professional navigates a complex world of numbers, rules, and human stories—Amay Patnaik, whose journey as an income tax officer reveals the unwritten rules behind tax compliance, enforcement, and public service. Far beyond the flash of enforcement raids or public criticism, his day-to-day reality blends meticulous auditing, urgent compliance checks, and an often unseen commitment to fairness. This deep dive into the world of income tax officers uncovers the daily rhythms, hidden burdens, and ethical tightropes walked by professionals like Patnaik—those who uphold fiscal integrity while navigating the intricate dance between law, trust, and human behavior.

From Form Drafting to Field Enforcement: Mapping a Typical Workday

For Amay Patnaik, a standard workday rarely follows a script. It begins before dawn with the review of advance tax filings, corporate returns, and inter-filing synergies. Tax assessment rounds follow stringent timelines, requiring precision in identifying deductions, crediting mismatches, and ensuring alignment with the Income Tax Act.

The process demands not only technical mastery but also an acute sense of urgency, especially during peak assessment seasons when load surges by over 40%. Whether preparing for audits or coordinating with forensic teams, every action is governed by directives from central authorities and state enforcement frameworks. Patnaik often cites the critical balance between proactive compliance encouragement and decisive enforcement—a duality that defines the officer’s strategic mindset.

His desk ergonomics translate into digital rigor: integrating data from various databases, cross-verifying PAN-linked information, and flagging anomalies that may signal tax avoidance or evasion. This hybrid landscape of analog and digital tools shapes a workflow where accuracy is non-negotiable, and oversight delay can ripple into systemic risk. The Dual Role: Enforcer and Educator in Tax Administration

Patnaik’s world reveals a dual identity—enforcer by mandate, educator by choice.

While audits and penalties occupy a central stage, teaching taxpayers about compliance remains a subtle but pivotal mission. Early morning state meetings often focus on simplifying complex provisions for micro-enterprises and individual filers, turning dense legal language into plain guidance. Behind closed doors, discussions center on landmark rulings and advisory interpretations that ripple across jurisdictions.

This dual role creates a nuanced professional identity. “You’re not just checking numbers—you’re building a bridge between law and understanding,” Patnaik reflects. “When a small business owner finally grasps the meaning of GST compliance, that’s real impact.” This balance shapes morale and performance, fostering deeper engagement beyond transactional obligations.

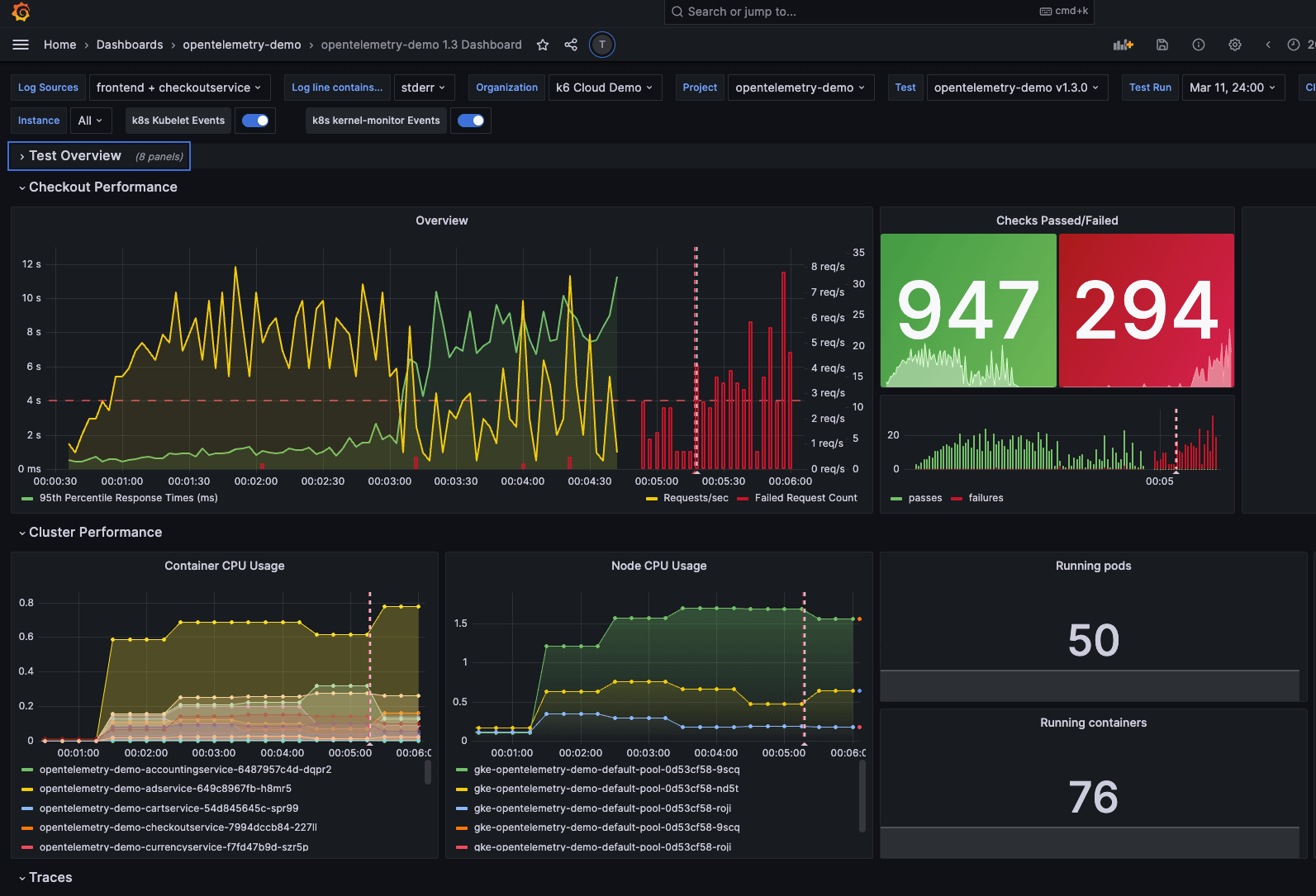

Technology as a Double-Edged Sword in Tax Administration

Modern tax offices, including those under officers like Patnaik, increasingly rely on digital infrastructure to streamline operations—from automated scanning and machine learning for anomalies to secure data-sharing platforms. Such tools accelerate assessment cycles and enhance transparency. Yet, integration gaps persist, especially when state-level systems lag.

Patnaik notes, “Technology amplifies efficiency—but human oversight remains irreplaceable.” Automated systems flag red flags, but discerning intent, context, and fairness demands journalistic skepticism and ethical judgment. Misinterpretation of data or over-aggressive algorithmic interpretation can fuel disputes, reminding officers daily that tools serve people, not the other way around. Moreover, cybersecurity threats pose a growing challenge, necessitating robust protocols to safeguard sensitive taxpayer data.

In this landscape, tax officers become both administrators and custodians of digital integrity—guardians of trust in an increasingly paperless era. Challenges Faced: Stress, Public Perception, and Ethical Tightropes

The psychological toll of the job manifests in chronic stress and emotional fatigue. Dealing with complex cases, tight deadlines, and high-stakes disputes places immense pressure on judgment and patience.

Long hours, often under the glow of rhythmic computer screens, become the standard but exacting rhythm. Public perception adds another layer of complexity. While tax systems aim for equity, media narratives frequently frame enforcement actions as adversarial, fueling skepticism.

Patnaik explains, “People see raids, but rarely understand the years of preparation behind each assessment.” This distance drives a quiet resolve: to audit with fairness, communicate clearly, and advocate for justice not just in law, but in human terms. Ethical dilemmas are constant—resisting undue pressure, avoiding bias, and maintaining transparency. The specimen of conduct demanded is firm but fair, principled but pragmatic.

Impact Beyond Data: The Human Side of Tax Compliance

Though rooted in numbers, the work of an income tax officer like Patnaik touches lives in profound ways. From small entrepreneurs navigating uncertain cash flows to salaried families securing refunds—each case carries personal stakes. Patnaik observes, “Every filing, every audit, every correspondence shapes a relationship between citizen and state.” A well-handled refund can uplift a family; a clarifying email can transform confusion into confidence.

These moments highlight that fiscal administration is not just about revenue—it’s about trust, dignity, and inclusion. His journey embodies how public service professionals balance legal rigor with compassion, reinforcing that behind every tax return lies a story of aspiration, responsibility, and belonging. Pioneering Reform: The Push for Transparency and Taxpayer Empowerment

Among Patnaik’s broader contributions is a quiet advocacy for digital transparency and taxpayer empowerment.

He actively supports reforms that limit processing delays, enhance e-filing accessibility, and standardize procedural clarity. “Technology unlocks potential,” he argues, “but only when paired with clear communication and accountability.” His insights, drawn from frontline experience, shape policy dialogues on reducing compliance gaps and fostering a fairer tax ecosystem—bridging the gap between bureaucratic systems and real-world understanding.

Their world blends deep technical knowledge with ethical conviction, turning statutory mandates into realities that shape economies and lives. Far from isolated roles in government offices, their work is a dynamic, human-centered effort that sustains trust, fairness, and the foundation of public finance. As data flows and regulations shift, one truth remains unwavering: in the quiet diligence of an income tax officer’s desk lies the pulse of economic justice.

Related Post

Mathematical Precision Unlocks Parking Fury: Decoding the Science Behind Perfect Spots Using Parking Fury Cool Math

Unveiling The Enigma Of Sophie Rain: Spider Erome’s Cryptic Simplicity

Who Won The 2006 World Cup: The Ultimate Guide to Germany’s Triumphant Glory

Table Tennis Player in English: A Simple Guide to Mastering the Game