Add Your Debit Card to STC Pay in Seconds — This Simple Guide Simplifies Mobile Payments

Add Your Debit Card to STC Pay in Seconds — This Simple Guide Simplifies Mobile Payments

In today’s fast-paced digital economy, making payments is no longer confined to cash, cards, or bank transfers alone. With STC Pay, one of the Caribbean’s leading fintech platforms, users now have a seamless way to effortlessly link their debit cards directly to their mobile wallet — eliminating friction and empowering instant transactions. Whether you’re settling bills, shopping online, or sending money to friends, adding your debit card to STC Pay offers a secure, efficient, and accessible solution tailored for everyday users.

This guide breaks down the entire process with precise steps, essential tips, and real-world insights to ensure you master the transaction effortlessly. STC Pay, backed by heavyweight operator STC Group, has positioned itself at the forefront of mobile financial services. The integration of debit card functionality transforms the app from a simple digital wallet into a full-fledged payment ecosystem.

Users can quickly verify, load, and activate their debit cards, enabling real-time transfers, merchant payments, and QR-based transactions across supported vendors throughout STC’s network.

At the core of using STC Pay with a debit card is convenience rooted in robust security and instant verification. Unlike traditional card-on-file setups that demand multiple steps, STC Pay streamlines the onboarding of your financial card through a transparent, user-first interface.

When activating your debit card, the system instantly validates your card details, checks for authenticity, and establishes a secure connection to your mobile device. This process, designed by payment security experts, reduces the risk of fraud while ensuring your funds remain protected at every stage. “We prioritize both speed and safety — users don’t have to choose between ease and protection,” notes a STC Pay platform representative.

“Adding your debit card is designed so you never feel overwhelmed — every step is clear and purposeful.”

To begin, ensure your device meets basic technical requirements: a compatible smartphone running the latest version of the STC Pay app, a stable internet connection, and a valid debit card issued by a bank affiliated with STC Pay’s network. Most major banks in the region support the integration, including regional financial institutions with ISO 8583-compliant infrastructure — a technical standard that ensures reliable card transaction messaging.

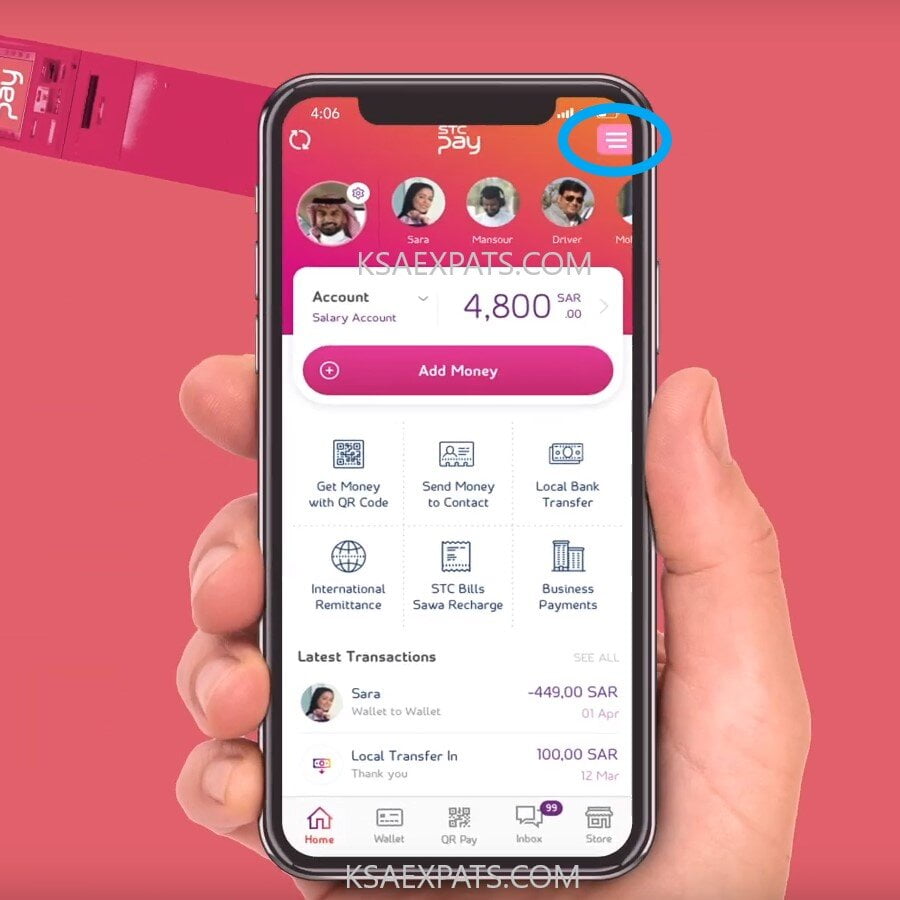

Step-by-Step: Seamlessly Link Your Debit Card to STC Pay

- Open the STC Pay App: Launch the official STC Pay application on your smartphone. If you haven’t installed it yet, the app is available for both iOS and Android with simple download links from the operator’s official website or app stores.

- Access Payment Settings: Navigate to the ‘Pay’ or ‘Transfers’ section, typically found in the bottom or top navigation bar.

Tap on ‘Add Card’ or ‘Link Debit Card’ — this option initiates the card registration workflow.

- Enter Card Details: Enter your debit card number, expiration date, and CVV securely. The app uses tokenization technology, meaning raw card data never touches the payment processor, drastically reducing exposure to data breaches.

- Choose Card Issuer and Verification Mode: Select the financial institution linked to your card; the app auto-detects many major issuers but allows manual input if needed. For enhanced security, many users opt for biometric verification — fingerprint or facial recognition — to confirm identity before proceeding.

- Submit and Confirm: Submit your details.

The system automatically validates the card’s authenticity and checks availability of the account. Within seconds, a confirmation appears — your debit card is now registered and ready for use.

- Enable Push Notifications (Optional): For real-time alerts, toggle on push notifications tied to transactions. This feature keeps you instantly informed of credit, debit, or pending actions, minimizing fraud risk and improving financial awareness.

One practical benefit noted by early adopters is the ability to test payments immediately after linking — whether paying a utility bill via QR code, sending money to a family member, or settling a merchant charge at a retail outlet.

The system maintains low latency, ensuring transactions mirror the speed of digital giants like Visa or Mastercard’s mobile platforms.

Technical Underpinnings: How Debit Card Integrations Work Securely

STC Pay’s architecture relies on industry-leading payment protocols and encryption standards. When your debit card is added, the system establishes a secure channel using Transport Layer Security (TLS 1.2 or higher) and secures card data via PCI DSS-compliant processes. Tokenization replaces sensitive card numbers with non-sensitive tokens, blocking unauthorized access even if intercepted.Furthermore, the platform leverages 3D Secure 2.0 for online and in-app payments, adding an extra authentication layer via OTP or biometric prompts. STC Pay’s integration with card networks such as VISA and Mastercard ensures compatibility across physical terminals, online gateways, and mobile terminals, making it versatile for both in-person and remote transactions. The backend processes requests in milliseconds, matching or exceeding standard mobile wallet speeds.

User experience remains a design priority — from card entry to transaction confirmation, errors are minimized through real-time feedback. For example, if a card is declined, the app immediately explains the issue — insufficient funds, expired card, or network outage — guiding quick resolution. This proactive approach builds trust and reduces support load significantly.

Real-World Use Cases: Transactions Made Easier Every Day

Consider a young professional in Grenada who normally juggles cash, cards, and bank transfers.By adding their debit card to STC Pay, they can split monthly expenses instantly — paying transportation fees, groceries, and utilities — all without visiting a bank. With QR code payments now embedded in local shops, restaurants, and transportation hubs, linking a card simplifies contactless acceptance and eliminates the need for physical cash.— Maria Delgado, SMB owner in Saint Lucia using STC Pay regularly. Another scenario involves remote workers earning abroad.

Once their debit card is linked, converting and transferring STC Balance or local currency funds via STC Pay becomes fluid, eliminating delays from traditional banking procedures. “It’s like having a digital bank account in my pocket,” says Ahmed Khan, Freelancer & STC Pay user in Trinidad.

Even in emergency or low-internet zones, STC Pay maintains reliable connectivity.

Cached transactions sync once a stable connection resumes, ensuring no missed payments during critical moments. This peace of mind is invaluable in regions where infrastructure variability can disrupt financial access.

Tips for a Smooth Setup and Long-Term Security

- Always review the card issuer details immediately after linking to confirm correct account association. - Enable biometric or multi-factor authentication for added layer protection beyond card PIN.- Regularly monitor transaction alerts via push or SMS to catch unauthorized activity early. - Use STC Pay’s built-in spend analytics to track card usage and budget responsibly. - Keep your app and phone software updated to benefit from the latest security patches.

- When transporting or storing card information, protect physical cards and avoid sharing QR codes with unverified contacts. By following these steps, users ensure not only functional access but also long-term control and security over their digital payments.

Why STC Pay’s Debit Card Integration Stands Out

What makes adding a debit card to STC Pay different from other mobile wallets?Simplicity. Unlike complicated structures requiring multiple accounts or intermediaries, STC Pay treats your debit card as a first-class citizen — linked directly, verified instantly, and activated within seconds. This direct integration reduces onboarding friction, eliminates redundant login steps, and streamlines transaction history in one unified dashboard.

Moreover, STC Pay’s commitment to local relevance ensures the platform aligns with regional banking standards, merchant adoption rates, and consumer behavior patterns. This localization deepens trust — users recognize active merchant partnerships, fast settlement times, and responsive customer support tailored to Caribbean usage contexts. Security remains non-negotiable.

Every transaction is scoped by user consent, encrypted end-to-end, and audited regularly to meet international compliance. The platform’s investment in continuous security improvements — including AI-driven anomaly detection and real-time fraud monitoring — reinforces its reputation as a trustworthy mobile payment gateway. In essence, adding your debit card to STC Pay isn’t merely a technical checkbox — it’s unlocking a faster, more secure, and more personal way

Related Post

Victor Osimhen’s Dazzling Tricks: A Showtime of Skill That Redefines Football Magic

Maurice Jones-Drew and the Jaguars: Age, Wife, and the Journey Behind the Jaguars’ Nuclear Core

The Curved Journey of Jessica Alba: From SoCal Star to Voices of Industry Change

How Lil Marlo’s Loyalty to “Too Loyal to Live” Led to His Murder – A Tragedy Unfolded on YouTube