99 Euros to Dollars: How Europe’s Currency Rate Shapes Global Trade and Travel

99 Euros to Dollars: How Europe’s Currency Rate Shapes Global Trade and Travel

At the heart of international finance lies a critical exchange rate: how many euros convert into U.S. dollars. With 99 euros today trading at approximately 104.50 dollars, a modest sum unlocks significant buying power across borders.

This conversion is far more than a transactional detail—it influences tourism, business investments, dividend repatriation, and cross-border trade. Understanding the dynamics behind the 99 euro-to-dollar value reveals insights into Europe’s economic resilience and the global weight of the euro as a major reserve currency.

The Current Exchange Rate: Precision and Fluctuation

As of the latest data, 1 euro equals roughly 1.06 U.S.dollars, meaning 99 euros approximate 104.50 dollars. However, currency markets operate dynamically, with rates shifting every few minutes based on macroeconomic indicators, inflation data, interest rate expectations, and geopolitical developments. The European Central Bank’s monetary policy, along with U.S.

Federal Reserve decisions, directly affects this ratio. For instance, if the ECB signals tighter policy or economic strengthening, the euro may appreciate; conversely, dovish Fed moves often boost dollar strength. Traders and financial analysts monitor real-time fluctuations closely, as even a 2% shift matters for multinational firms and individual travelers alike.

This value of 99 euros to 104.50 dollars reflects more than a snapshot—it encapsulates investor sentiment toward the euro’s stability post-pandemic, energy market volatility, and Europe’s recovery trajectory. It acts as a barometer for broader Eurozone confidence, influencing everything from import pricing to foreign direct investment decisions.

Why 99 Euros Matter: Daily Transactions and Broader Implications

For travelers, entrepreneurs, and global professionals, understanding how 99 euros translate to dollars determines real-world purchasing power. A €99 meal in a German café isn’t just a local expense—it becomes $104.50 in dollar terms, reflecting exchange impacts on daily routines abroad.For business leaders, 99 euros could represent revenue, expense, or capital repatriation, directly affecting balance sheets and operational costs. Consider a U.S. importer sourcing goods from Frankfurt: when converting 99 euros at 104.50 dollars, the effective cost conversion becomes 10,351.50 dollars.

Small deviations in the exchange rate compound into six- or seven-figure differences, shaping pricing strategies. Similarly, a European startup raising dollar-denominated funding with euro-based operations must assess currency risk meticulously—stable or favorable conversion rates protect margins and investor returns.

The interplay of €99 and $104.50 underscores how sensitive global commerce remains to currency fluctuations.

Every transaction amplifies the importance of accurate, up-to-date forecasting and currency risk management.

Factors Driving the Euro-Dollar Ratio

Several key factors influence the €-to-$ conversion: - **Interest Rates:** More aggressive ECB hikes compared to the Fed can attract dollar flows, pushing the euro lower. Conversely, ECB rate cuts may weaken the currency. - **Inflation Differentials:** Persistent inflation in the Eurozone versus the U.S.affects relative currency strength—lower inflation often supports a stronger euro. - **Trade and Fiscal Stability:** Strong Eurozone GDP growth encourages dollar outflows, tightening demand for euros and lifting the exchange rate. - **Geopolitical Risks:** Crises in Europe or global instability influence investor flows—dollar often emerges as a safe haven, benefiting the USD.

- **Market Speculation:** Trader behavior and algorithmic trading amplify short-term swings, creating volatility beyond fundamentals. These variables ensure that 99 euros convert to more or less than $104.50 depending on current economic stewardship and market psychology.

Historical Context and Long-Term Trends

Since the euro’s launch in 1999, its exchange rate against the dollar has seen pronounced swings.In the early 2000s, the euro appreciated sharply against the dollar, peaking above 1.60 by 2002, partly due to ECB tight monetary policy. The Global Financial Crisis of 2008 shifted balance toward the dollar, depressing the euro to below 0.80. Since then, a steady, gradual dollar strength emerged—though recent divergences reflect policy divergence.

Between 2012 and 2022, the dollar gained over 20% in value compared to the euro, driven by ECB caution amid sovereign debt crises and the Fed’s aggressive rate rises. Yet since 2023, tighter ECB easing and persistent Fed hawkship have realigned pressures, creating ripples visible in euros-to-dollars conversion rates. Today’s 99-to-104.50 move echoes a return to more balanced conditions—but not stability, rather a cautious equilibrium shaped by evolving macro forces.

Understanding this history helps contextualize why 99 euros remain a meaningful number in dollar terms—not just a statistic, but a signal of Europe’s economic navigation through turbulence.

Practical Guidance: Optimizing Transactions with Euros and Dollars

For individuals and businesses managing cross-border flows, avoiding poor timing is crucial. Key strategies include: - **Monitor Rates in Real Time:** Use financial platforms or currency alerts to capture favorable midpoints near 104.50. - **Hedge Currency Risk:** Forward contracts or options shield against unexpected adverse shifts.- **Plan Purchases Strategically:** Large conversions near rate peaks may trigger higher costs—spread orders over time. - **Consult Financial Advisors:** Complex operations, such as repatriating euro earnings or funding cross-border ventures, benefit from expert insight. For travelers, timing a euro-to-dollar swap around rate changes

Related Post

A Deep Dive Into Submarine (2010): The Gem That Technical Mastery Meets Undersea Drama

Are Patrick Dempsey and Ellen Pompeo Really Friends? The Truth Behind Their Public Affair and Shared Past

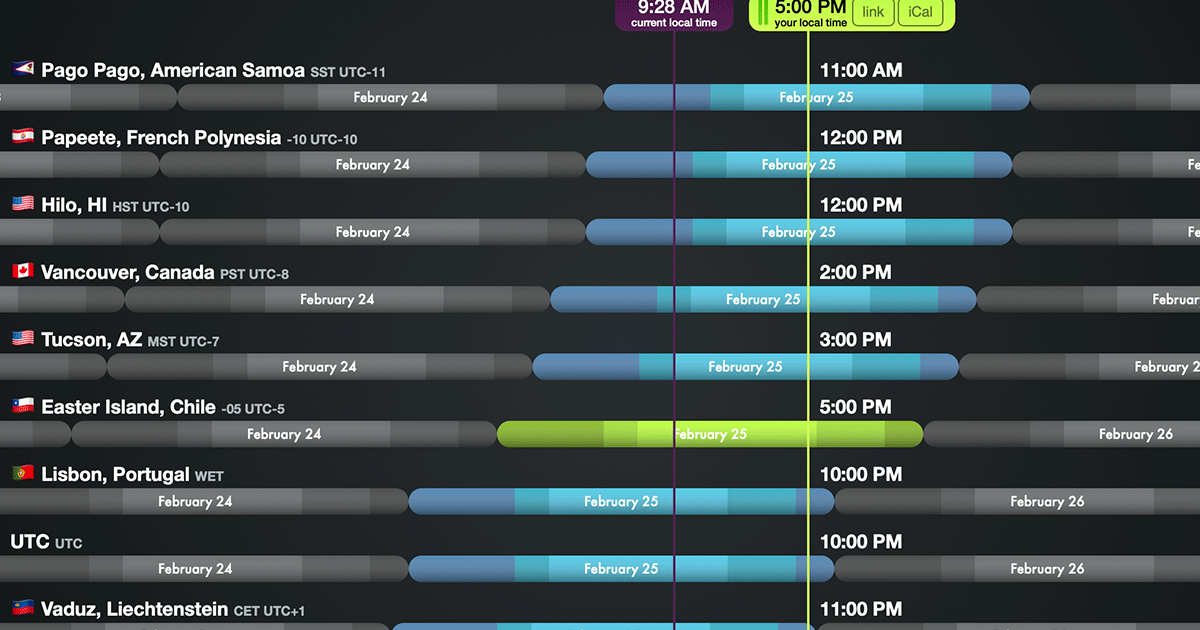

Are We On Central Standard Time? Decoding the Clock’s Every Move in the Midday Zone

Princess Sparkles Unraveling The Magic Of Trolls: Secrets Beneath the Gleam